1

Measuring air connectivity between China and Australia

Abstract: This paper assesses air connectivity between China and Australia for the period

2005–16 using a Connectivity Utility Model. Our direct connectivity measure shows that as a

gateway city, Sydney continues to play a key role in facilitating the movements of people and

goods between China and Australia. Guangzhou has become the city best connected with

Australia since 2011 as measured by direct connectivity. When indirect connections are

considered, the largest increases in overall connectivity from 2005 to 2016 can be observed

among Australia’s major capital cities, particularly Sydney, Melbourne and Brisbane.

Chinese carriers are the key drivers behind the increases. There have been rises and falls for

airports serving as a hub between China and Australia. Guangzhou has forged its strong

status as a transfer hub between Australia and China thanks to the quick expansion of China

Southern. The gaps between Guangzhou and other transfer hubs measured by hub

connectivity have widened since 2010.

Key words: Direct connectivity; indirect connectivity; hub connectivity; air transport; China;

Australia

2

1. Introduction

Air transport between Australia and China has experienced a phenomenal growth during the

past decade. In 2005 only Beijing, Shanghai and Guangzhou in China had direct flights to

Sydney and Melbourne in Australia. At that time, many Chinese travellers used Hong Kong,

Singapore and even Seoul, Korea as a transfer point to Australia. However, in 2016, there

were seven Chinese airlines providing direct flight services between China and Australia –

from ten cities in China to Australia’s major capital cities, although Sydney and Melbourne

remained the most interested destinations.

In December 2016 an open skies arrangement was concluded between China and Australia. It

removed all capacity restrictions for each country’s airlines. This arrangement arose through

an intention to cater for the increasing number of Chinese visitors to Australia. Since 2010

Chinese tourists have been Australia’s biggest spenders, and the China market is expected to

be the most valuable inbound market for the next decade (Zhang and Peng, 2014).

Geographers have identified the expansion of air transport as one of the key drivers of

globalisation (Adey et al., 2007). Air transport has not only facilitated tourism between China

and Australia, but it has also provided access to new markets for businesses in both countries.

China has been Australia’s largest trading partner since 2009. Although China and Australia

concluded a free trade agreement in 2015, it is understood that trade barriers due to

infrastructure and transport services, especially air transport services, cannot be resolved

easily in a free trade agreement because most free trade agreements do not address the

liberalisation of air transport services. Improving connectivity is increasingly a topic at the

top of international trade and transport policy agenda (Calatayud et al., 2016).

Scholarly research into the air transport connections between the two nations is rare. Gao and

Koo (2014) might be the only academic paper to discuss the emergence of the ‘Canton

Route’. A comprehensive assessment of the air connectivity between the two countries is

lacking. Huang and Wang (2017) investigated the spatial patterns of indirect connections of

the top hub airports in China for 2012 and 2015, but they did not specifically address the

connectivity between China and Australia. Considering the strong economic ties between

China and Australia, it is necessary to assess the air connectivity between the two nations

given its strong relationship to economic development and growth (Basile et al., 2006; Zhang,

2012; Banno and Redondi, 2014; Li and Qi, 2016). It is particularly important for a city or a

3

region to understand the level of its air connectivity in the air transport network in order to

attract tourists, business investment and human capital.

In considering both the direct and indirect connections for Chinese and Australian cities for

the period 2005–16, we make two contributions. First, this paper extends the Connectivity

Utility Model (ConnUM) developed in Zhu et al. (2018) and considers all of the flight

schedule information in calculating the air connectivity at the airport/city and national levels,

which is of great value to governments at all levels for identifying gaps in air service

provisions, detecting weak points in the existing transport network and seeking ways to

improve the reliability and accessibility of the network to reduce travel time and costs (Hadas

et al., 2017). This research also examines the hub connectivity of the key airports that have

served as transfer hubs between China and Australia, which will provide a strong basis for

airport managements to develop strategies to boost their hub status. Second, in the airline

economics literature there are numerous studies examining the relationship between air

service provision and economic activities (see, e.g., Button and Taylor, 2000; Matsumoto,

2004, 2007, Matsumoto et al., 2016). However, few of these studies use a comprehensive and

systematic measure of air transport service provision that captures consumers’ utility. The

comprehensive and consistent measure for air connectivity developed in this research will

provide a better proxy of air service provision and can be used in future studies examining the

effects of air transport on economic activities.

The next section will review the relevant literature, followed by a description of the ConnUM

for measuring air connectivity. Section 4 reports the results and interpretations. The last

section provides a summary and a conclusion.

2. Literature review

A safe and well-connected transport network is vital for the efficient functioning of a

country’s economy. Numerous literature has examined the intertwined relationship between

air transport and economic development (see, e.g., Cristea 2011; Banno and Redondi, 2014;

Van De Vijver et al., 2014; Matsumoto et al., 2016). Baker et al. (2015) reveal significant bi-

directional relationship between regional economic growth and regional air transport services

in Australia. Blonigen and Cristea (2015) provide strong evidence that a 50% increase in an

average city’s air traffic growth could result in an additional 7.4% increase in real GDP in the

US. Liu et al. (2013) show that cities with a higher level of air connectivity are appealing to

4

globalised business service firms, which in turn can stimulate the development of aviation

connections. However, Ng et al. (2018) argue that transport infrastructures have a strong

influence over the patterns of regional and national development, but such influence is greater

on the more established cities ad areas. In particular, O'Connor (2010) and O'Connor et al.

(2016) pointed out that a large part of the world’s sea and air cargoes are handled at a small

number of cities and places, which play a significant role in the location decisions of the

largest logistics service companies. Therefore, the aviation gateway cities have significant

implications to a country’s economy (O’Connor and Fuellhart, 2015).

There has been much literature evaluating air services at cities (see, e.g., Derudder and

Witlox, 2014). For a long time, Tokyo, Hong Kong and Singapore were the most important

international aviation hubs in East Asia (Matsumoto, 2004, 2007). However, Matsumoto et

al. (2016) found that Seoul, Guangzhou, Ho Chi Minh City and Hanoi, have been rising

rapidly in terms of their aviation hub status since 2000. De Wit et al (2009) reveal that while

Tokyo has the best network performance and hub competitive position in the Asia Pacific

rim, Chinese airports are experiencing the most striking growth of network development.

They also found that the network performance deteriorates at Oceanian airports. O’Connor et

al. (2018) examined the distribution of air services among Chinese cities between 2005 and

2015 with a consideration of the number of routes, departures, and the number of seats

available. They found that the competitive position of Chinese cities in the nations’ air

transport market did not changed much during the studied period. Although a small number

of regional cities have strengthened their role in the air transport network, the ranks of the

seven leading cities remain unchanged. In particular, cities in the three mega-metropolitan

regions, Beijing–Tianjin, Shanghai, Hong Kong–Shenzhen–Guangzhou, play a dominant role

in China’s air transport systems (Zheng et al. 2009, Wu and Dong, 2015).

Air transport deregulation is one of the key factors that drive the changes in airlines’

behaviour and the provisions of air services at national, regional and local levels (Goetz and

Sutton, 1997; Burghouwt and Hakfoort, 2001; Wei, 2007; Williams, 2009). Wang et al.

(2014) analyse the evolution process of the air transport network of China from 1930 to 2012

and report a three-stage evolvement since the 1980s when the deregulation process began:

hub formation, a complex network structure and emerging multi-airport systems. Over the

last 20 years, Chinese major carriers have developed multiple hubs (bases) through mergers

and acquisitions (Zhang and Round, 2008). Such expansion was supported by the local

5

governments--many secondary cities in China provide subsidies to attract airlines to build

bases and operate international services out of their local airports (Zhang and Lu, 2013). In

the case of Australia, O’Connor (1998) observed a shift of the country’s international airline

linkages in favour of the Asian countries from 1985 to 1996, reflecting the shifts in trade and

immigration. Such shifts strengthened the role of Cairns and Brisbane as gateways for the

tourism industry, but the dominance role of the nation’s aviation gateways, Sydney and

Melbourne, was not weakened, which is still the case today (Fuellhart and O’Connor, 2013;

O’Connor and Fuellhart, 2015; O’Connor, 2018).

When assessing the air services at cities and regions, researchers have used different

definitions for air connectivity. Traditional approaches to measuring air connectivity include

the number of destinations or the number of direct flights from/to an airport. A good review

of recently developed connectivity models can be found in Burghouwt and Redondi (2013),

Suau-Sanchez et al. (2015), Calatayud et al. (2016) and Zeigler et al. (2017). Calatayud et al.

(2016) show that some transport economics literature defines connectivity based on

infrastructure availability and capacity (see, e.g., Moreno and Lopez, 2007; Wilmsmeier and

Hoffmann, 2008). Márquez-Ramos et al. (2011) referred to this as a narrow concept of

connectivity because this definition only focuses on the physical properties of a network. A

broader definition for connectivity emphasises the importance of the availability and the

capacity of transport services within the framework of complex systems theory (see, e.g.,

Alderighi et al., 2007; Malighetti et al., 2008; Redondi et al., 2011). Zeigler et al. (2017) note

that one stream of air connectivity measures is constructed based on flight schedule date such

as the NetScan (Veldhius, 1997) and the accessibility index (Redondi et al., 2013) models.

Another stream of measures is demand-based studies which require the use of passenger

traffic or booking data (e.g., Wang et al., 2011). The connectivity measure used in this

research is the single transport mode version of the model developed in Zhu et al. (2018) that

has its origin in the NetScan model. The ConnUM incorporates multiple quality-adjustment

factors such as capacity and velocity penalties so as to correct/adjust for the quality of a

connection. It can be used to measure the direct and indirect, single- and multi-modal

connections of a city, region or country. By revealing the level of air connections of cities in

China and Australia using such a comprehensive measure, this research will add knowledge

to the understanding of the hierarchy and the specific roles of cities in the two countries.

6

3. Methodology

2.1 The Connectivity Utility Model

The ConnUM is modified to consider the air transport mode only. By incorporating multiple

connection quality factors such as travel time, speed, comfort and convenience, the

connectivity calculated in this study captures air passengers’ travel utility and reflects both

the quantity and quality levels of air transport services provided to passengers. The

construction of a modified ConnUM measuring air connectivity is briefly described below.

1

Previous literature such as Vowles (2001), Bowen (2010), and O’Connor and Fuellhart

(2012) has shown that airline type, aircraft used and low cost carrier (LCC) operations are

significant factors that can shape the air service at a city. In fact, for most travellers the

availability of seats (capacity), trip duration (velocity) and the quality of transfer (for indirect

connections) are among the most important quality factors. These are considered in our

model. Considering that dissatisfaction with any one of those three preferences would lead to

0 utility (Keeney, 1974), a multiplicative utility function is adopted. We use equal weights for

all preferences.

2

For convenience, the utility scores of capacity, velocity and transfer quality

are named as capacity discount, velocity discount and transfer discount, respectively. The

connectivity of flight k from airport i to airport j is:

3

Connectivity

=

×

×

(1)

where

denotes the capacity discount for connection k between airports i and

j.

represents the velocity discount and

is the transfer discount.

4

As noted in Zhang et al. (2017), capacity is a key indicator measuring connection quality.

Larger aircraft are usually preferred by passengers as they tend to carry more passengers, and

provide more seats and space (Coldren et al., 2003). A concave function in the form of a

1

Readers can refer to Zhu et al. (2018) for the full methodology for constructing the multi-modal connectivity

measure based on ConnUM.

2

We tried different weights and the results were quite consistent.

3

k represents a unique connection (direct or indirect) between origin airport i and destination airport j. Every

connection on a route between airport i and airport j is treated as a different connection, even for the

connection with the same flight number on a different date, as the connection might use a different type of

aircraft and thus represents a unique level of service quality. This implies that the frequency for every

connection is always 1. We understand that in reality, many people would regard a flight as a direct flight if it

has an intermediate stop, but there is no change in the flight number.

4

Transfer discount is always 1 for direct flights.

7

squared root is used for measuring capacity discount. This is because the marginal benefit of

having more seats in a plane diminishes after a certain point, and the extra benefit of having

an additional 100-seat flight is greater than that of changing a 100-seat aircraft to a larger

aircraft with a capacity of 200 seats for a connection. This reflects the fact that passengers

place more value on frequency (Wei and Hansen, 2005). We choose the capacity of the

largest aircraft in use in 2005, 434 seats, as a benchmark to calculate the capacity discount,

5

which can be expressed as:

=

Seat

(2)

where

represents the number of seats on connection k. For an indirect connection it is

the number of seats of the flight segment with a smaller seat capacity. Seat

is the number of

seats of the benchmark aircraft, which is 434 in this study.

Velocity is another important indicator for connection quality. If the passenger takes an

indirect connection, the time he/she spends at the transit stop would be more uncomfortable

or stressful than the in-flight time. Therefore, both the extra time needed at the airports and

the penalty for transfer should be reflected in the velocity discount. The velocity discount is

calculated based on the following system of equations:

=

+ p

×

+

(3)

Velocity

=

(4)

D

=

Velocity

Velocity

(5)

where

is the adjusted time length (duration) of connection

from

to

. The scheduled in-flight time between two airports is the difference

between the scheduled arrival time and scheduled departure time,

6

represented by

. Extra time at the airports is represented by

. For indirect

connections the additional penalty for spending time at the transfer airport is a penalty factor

5

In effect, we can choose any type of aircraft as our benchmark because it will only affect the scale of the

capacity discount and, subsequently, the connectivity scores without hampering the purpose of comparing

these scores across airports or over years.

6

Transfer time is included in indirect connections. We understand that the actual flying time might be shorter

than the published estimated flying time as these days longer taxiing time at the busy airports is required and

the estimated flying time will have to consider this as well as other infrastructure constraints.

8

p

times

. The velocity (Velocity

) is calculated by dividing the great circle

distance between airport i and airport j by the adjusted time duration. The velocity discount is

calculated by comparing the velocity of a connection against the benchmark velocity,

Velocity

, which is assumed to be 850 km/h.

7

In this study we assume that the extra time

needed at the airports (both departure and arrival airports) is 100 minutes for domestic flights

and 180 minutes for international flights. Also, following previous literature such as De Wit

et al. (2009), we assume the extra penalty for transfer time to be 50%.

The quality of indirect connections is largely dependent on the quality of transfer. Two

aspects of the transfer quality are considered here: time and service. The time quality for

transfer measures the quality of transfer time. When the transfer time is too short, passengers

will have to rush to the boarding gate for the next flight, but still have a high chance of

missing the connection. Thus, the transfer time quality is very low. However, if the transfer

time is too long, the long wait will result in lower transfer quality. The transfer time quality

function is thus built by mapping the difference between the transfer time and the minimum

connection time (MCT) at an airport,

, for each indirect connection.

8

We set the time

quality as 0.2 when the transfer time is the same as the MCT, 1 when the transfer time is 30

minutes longer than the MCT and 0.7 when the transfer time is 3 hours or more than the

MCT.

9

The time quality function is as follows:

=

0,

< 10

+ 10× 0.02, 10

< 0

30

× 0.8 + 0.2, 0

< 30

1

30

500

, 30

180

0.7,

> 180

(6)

7

Statista (2018) suggests that major commercial jet aircraft cruise at about 420–500 knots or 778–926 km/h.

Therefore, we assume that the average speed is 850 km/h.

8

The MCT standards used here are those published by China Eastern Airline at Shanghai Pudong International

Airport and Shanghai Hongqiao International Airport. That is, the MCT is 120 minutes if the transfer is within

the same terminal and 160 minutes if the transfer occurs between terminals.

9

We acknowledge that the assignment of the value of 0.2 is arbitrary and the connectivity values will depend on

the values assigned to the time and service qualities. One can always try different values for these parameters,

but this would not change the ranking order of the airports considered. However, future studies can consider

using survey data to elicit more accurate values for these parameters.

9

where

represents the time quality for using indirect connection k from airport i to airport

j;

represents the difference between the transfer time and the MCT at the transfer airport

for indirect connection k.

The service quality for transfer measures the quality of transfer services such as walking

distance, waiting lounge comfortableness and the availability of a flexible arrangement when

a connection is missed. Service quality is different for different indirect connections. In most

instances the service quality is mainly decided by the relationship between the airlines

operating the two flight segments. When both flights are operated by the same airline or by

airlines in the same alliance, the transfer service quality is generally better than the situation

where the two segments are operated by two separate airlines without any cooperation

agreement. In the case where one flight is operated by a LCC, the service quality would be

relatively less desirable. Therefore, in this research the service quality for a transfer is

assumed to be 1 when both flights are operated by the same airline and there is no LCC

involved. A value of 0.9 is assigned for the service quality when the two segments are served

by two airlines from the same alliance group. The value is 0.3 when two full-service airlines

from different alliance groups are involved.

10

If the whole journey is served by the same

LCC, the service quality is also assumed to be 0.3. We give a value of 0.1 to service quality

for all other situations.

11

The transfer discount can be expressed as:

=

×

(7)

where

represents the time quality for the transfer of indirect connection k from airport i

to airport j, and

is the service quality of transfer for indirect connection k from airport i to

airport j.

10

It should be noted that this study does not distinguish the experiences of different travel cabins.

11

The transfer service quality may also be affected by the transfer airport’s facilities and services, which may

cause an overestimation of indirect connectivity if the transfer airport’s facilities and services are less

desirable to passengers.

10

For simplicity, this research only considers one transfer for an indirect connection.

12

This is a

realistic simplification as the vast majority of passengers travelling between Australia and

China use direct flights or indirect flights with only one transfer point. Two types of

connections, direct and indirect, are shown in Figure 1. De Wit et al. (2009) also identified a

third type of connection: hub connection. In the indirect connection shown in Figure 1,

airport x acts as a transfer hub, enabling the cooperation between connection k

1

and

connection k

2

. This type of hub connectivity is known as centrality (Burghouwt and Redondi,

2013). The centrality of airport x is the total connectivity of indirect connections with a

transfer at airport x. The centrality of airport x can be defined as:

centrality

= connectivity

,,

(8)

Figure 1: Two types of connections: direct and indirect.

The directional connectivity from airport i to airport j is the connectivity of route ij, which

is the aggregate connectivity for all connections (direct and indirect) on the route:

connectivity

= connectivity

(9)

The connectivity of airport i is the aggregate of the connectivity for all routes starting or

ending at airport i, which can be expressed as:

connectivity

= connectivity

+ connectivity

(10)

2.2 The data

Given the restriction of data availability, we consider a period from 2005 to 2016. For each

year, two weeks’ flight information was collected: 10–16 April and 10–16 November. All the

12

We understand that we may underestimate the connectivity when passengers use two or more transfers.

However, in 2016, only 1.7% of the passengers travelling from China to Australia involved two or more

transfers according the AirportIS database.

Airport i

Airport j

Connection K

Airport

j

Airport x

Airport i

Connection K1

Connection K2

11

direct flight information to and from China and Australia was extracted from IATA AirportIS

database.

13

The flight data includes the flight number,

14

the number of seats, the origin

airport, the destination airport, and the take-off and landing times. The time zone is then

matched to every airport and the airline block time is calculated in minutes. As the

connection dataset is a full set of all available air services to and from Chinese and Australian

airports, the overall connectivity and centrality are produced for all airports involved.

15

Indirect connections are generated with the direct connection data for all Chinese and

Australian airports, following the enumeration methods with programs coded in R language.

The produced indirect connection dataset is then filtered with loose constraints in travel

distance and transfer time: when taking indirect connections, the total distance of the

connection is constrained to be smaller than twice the direct distance between the origin and

destination airports; the transfer time at hub airports is limited to between 30 minutes and 24

hours. The distance and transfer time constraint can be expressed as:

+

2 ×

(11)

30

1440

(12)

where

denotes the great circle distance

16

between origin airport i and transfer

airport x;

denotes the great circle distance between transfer airport x and

destination airport j;

denotes the great circle distance between origin airport i and

destination airport j;

denotes the transfer time at the transfer airport for indirect

connection k from airport i to airport j. Another obvious constraint for indirect flights

connecting China and Australia is that the original airport and the destination airport must be

in either China or Australia.

4. Results and Analysis

3.1. Direct connectivity

13

The AirportIS database is constructed based on the reported information from IATA’s Billing and Settlement

Plan (BSP). The BSP reported information does not include data from low cost carriers, direct airline sales,

scheduled charter or other carriers not using agencies. In areas where the ticket sales are not supported by BSP,

there would be no ticket sales information.

14

For code-sharing flights, only the operating flights are retained.

15

Flights from mainland China to Hong Kong and Macau are treated as international flights.

16

All great circle distances in this research are calculated with the Python package ‘Geographiclib’ using tGPS

coordinates of OD.

12

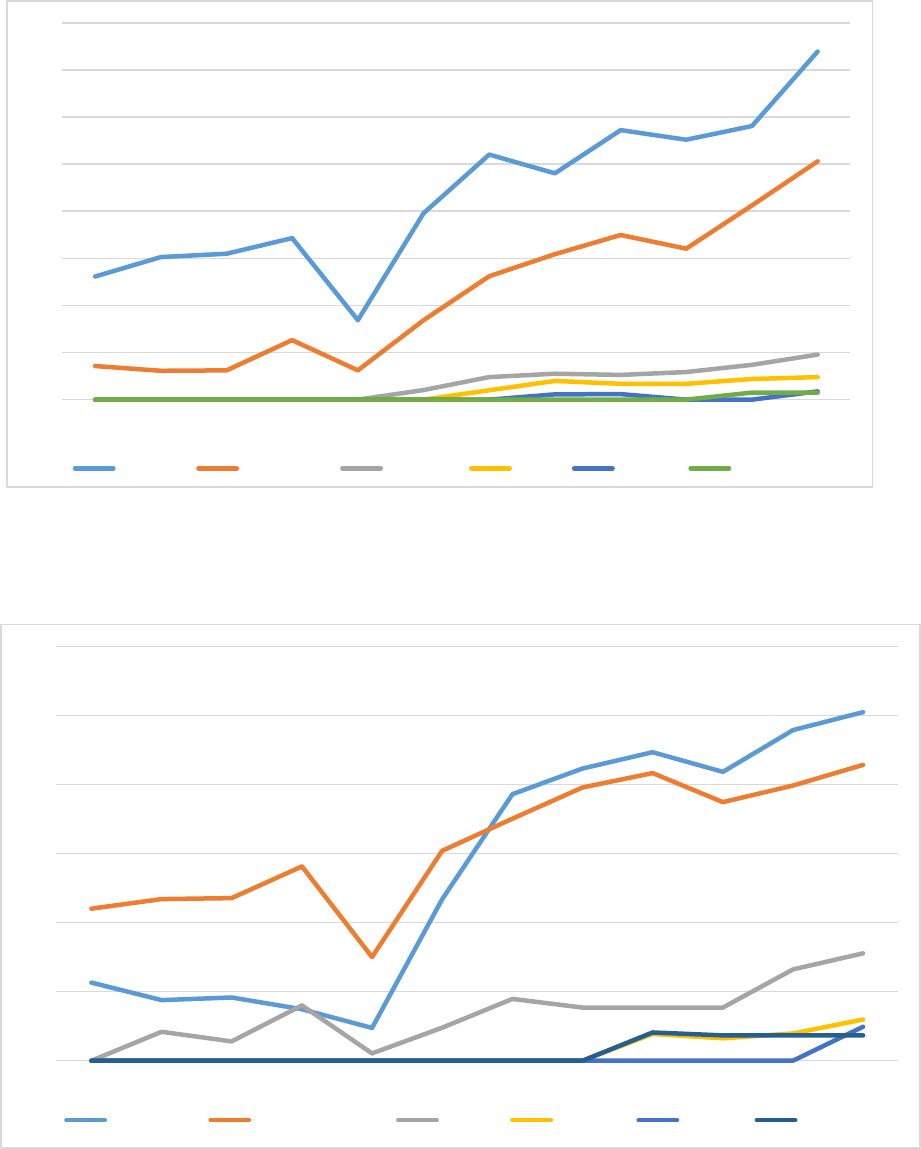

Figures 2 and 3 show the direct connectivity between Australia and China of selected airports

of the two countries for the period 2005–16, respectively. It can be seen that before 2010 only

Sydney and Melbourne had direct connections to mainland China and only Shanghai,

Guangzhou and Beijing were connected to Australia with direct services. Through China

Southern, direct air services became available for Brisbane and Perth from 2010 and 2011,

respectively. The direct connectivity score of Sydney almost tripled from 52 in 2005 to 148 in

2016. During the same period, the direct connectivity score for Melbourne increased from 14

to 101. The connectivity difference between Sydney and Melbourne can be considered

substantial, given that in 2016 the connectivity sores for Brisbane and Perth were only 19 and

14, respectively. This is consistent with the findings reported in O’Connor (2018) that

Sydney accounted for about 50% of passengers on direct services between China and

Australia in 2016 and this number was about 30% for Melbourne. It is apparent that Sydney

was in a leading position throughout the period in terms of the direct connectivity with China.

The 2009 global financial crisis had a strong and negative impact on air connectivity and the

direct connectivity almost halved for Sydney in 2009 but it rose quickly in 2010 and

continued to grow in the following years. As a gateway and global city (O’Connor, 2018),

Sydney continues to play a key role in facilitating the movements of people and goods

between China and Australia.

Of the Chinese cities, Shanghai Pudong had the lead in direct connectivity before 2011,

followed by Guangzhou and Beijing. However, Guangzhou surpassed Shanghai from 2011

and became the city best connected with Australia. Chengdu, Nanjing and Chongqing

established their direct connection with Australia from 2013 and more Chinese secondary

cities launched direct services to Australia in 2016, including Hangzhou, Qingdao, Fuzhou,

Xiamen and so on. The ongoing deregulation in China’s domestic market and the more

liberal arrangement between China and Australia is key to this outcome.

13

Figure 2: Direct connectivity (vertical axis) between Australia and China at Australian

airports, 2005–16.

Figure 3: Direct connectivity (vertical axis) between Australia and China at Chinese airports,

2005–16.

0

20

40

60

80

100

120

140

160

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Sydney Melbourne Brisbane Perth Cairns Gold Coast

0

20

40

60

80

100

120

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Guangzhou Shanghai Pudong Beijing Chengdu Xiamen Nanjing

14

As shown in Figure 4, in 2016 China Southern was the largest contributor to the direct

connectivity between China and Australia (38%), followed by China Eastern’s 21.8% and Air

China’s 18.6%. Qantas made a contribution of only 6.2%.

Figure 4: Individual carriers’ contribution to direct air connectivity between China and

Australia in 2016.

3.2 Overall connectivity (direct and indirect)

The overall connectivity scores of Chinese and Australian airports considering both direct

and indirect connections are reported in Appendices 1 and 2. The airports are ranked based on

their overall connectivity in 2016. Note that only indirect connections with one transfer point

are considered in constructing the overall connectivity indices. Thanks to the contribution of

indirect connections, we can see that the values of overall connectivity of the major cities in

the two countries are 10–20 times higher than those of direct connectivity, implying that

indirect connections give people living in these cities more choices for travelling between

China and Australia.

Due to the small number of large cities, in general, Australia’s main airports have much

higher overall connectivity than their Chinese counterparts as these cities have good

connections with major Asian hubs, which gives them a higher level of indirect connectivity.

However, for its smaller cities their overall connectivity (purely due to indirect connections)

China

Southern,

108.21, 38%

China Eastern,

59.09, 21%

Air China,

52.73, 19%

Qantas, 17.69,

6%

Xiamen, 17.21,

6%

Sichuan,

12.95, 5%

Hainan, 9.91,

3%

Others, 6.54,

2%

China Southern China Eastern Air China Qantas

Xiamen Sichuan Hainan Others

15

is rather small in value, suggesting limited air services between Australia’s regional and

remote areas and its capital cities.

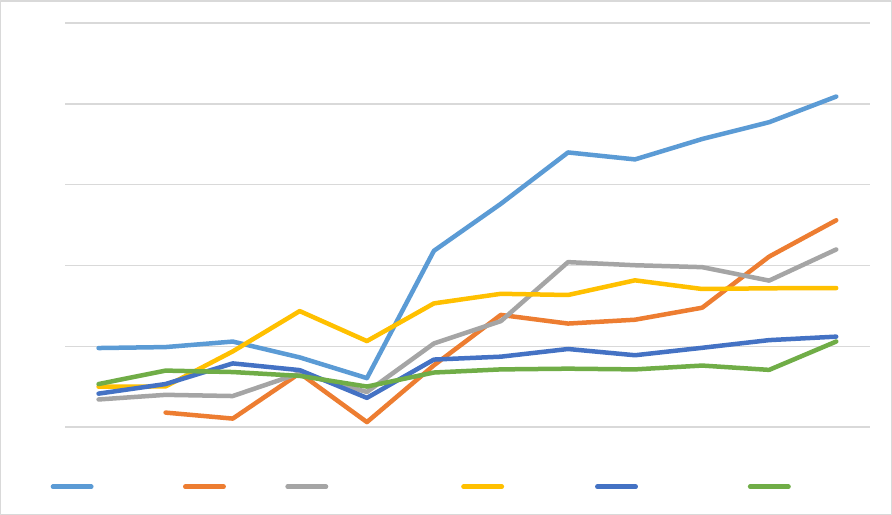

Figures 5 and 6 present a comparison of the connectivity between 2005 and 2016 for

Australian and Chinese airports, respectively. A substantial increase in overall connectivity

can be observed for Sydney, Melbourne, Brisbane and Perth airports in the former. The

increases for major Chinese airports were also impressive but were not comparable with the

large increases in Sydney and Melbourne. The trend can be seen more clearly in Figures 7

and 8, which show that the growth rate is much higher for Australia’s major cities,

particularly Sydney and Melbourne. Shanghai remained the best connected city in China

throughout the period. However, the connectivity of Beijing and Guangzhou had caught up to

it quickly by the end of 2016. Beijing surpassed Guangzhou to be the second best connected

city with Australia, and was very close to Shanghai. The connectivity scores of many

secondary cities did not differ much and they experienced modest growth (Figure 7).

Figure 5: Comparison of overall connectivity for Australian cities (the size of the circle

represents the level of connectivity in 2016).

16

Figure 6: Comparison of overall connectivity for Chinese cities (the size of the circle

represents the level of connectivity in 2016).

Figure 7: Overall connectivity (vertical axis) evolution trend at major Australian airports,

2005–16.

0

500

1000

1500

2000

2500

3000

3500

4000

4500

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Sydney Melbourne Brisbane Perth Cairns Adelaide

17

Figure 8: Overall connectivity (vertical axis) evolution trend at major Chinese airports,

2005–16.

We have calculated the loss of the overall connectivity between China and Australia if a

carrier is excluded from the network in 2016. The results are reported in Table 1. If China

Southern dropped out in 2016 the overall air connectivity between the two countries would

suffer a loss of 39.1%. The exit of China Eastern would result in a reduction in connectivity

by 20%, followed by Air China’s 17.7%, Qantas’ 14% and Cathay Pacific’s 12.6%.

Table 1: The loss of overall connectivity if an airline ceased operation in 2016.

Airline

Loss of air connectivity

China Southern

39.1%

China Eastern

20.0%

Air China

17.7%

Qantas

14.0%

Cathay Pacific

12.6%

Cathay Dragon

11.3%

Singapore Airlines

6.1%

Xiamen Airlines

4.9%

Shenzhen Airlines

3.0%

Thai Airways

2.8%

Korean Air

2.1%

Virgin Australia

1.8%

0

100

200

300

400

500

600

700

800

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Shanghai Beijing Guangzhou Chengdu Xiamen Nanjing

18

3.3 Hub connectivity

The level of centrality at the transfer airport represents the service level of the airport as a

transfer hub. Table 2 presents the top ten airports that had the highest hub connectivity in

selected years from 2005 to 2012. Figures 9 and 10 show the map of centrality for the major

cities in 2005 and 2016, respectively. In 2005 the top ten were Guangzhou, Sydney, Hong

Kong, Kuala Lumpur, Tokyo Narita, Singapore, Seoul Incheon, Bangkok, Shanghai Pudong

and Brisbane while in 2016 they were Guangzhou, Beijing, Shanghai Pudong, Hong Kong,

Seoul Incheon. Sydney, Taipei, Singapore, Bangkok and Chengdu. Throughout the period,

Guangzhou remained the best connected city except in the 2008–09 period when Guangzhou

was hit severely by the global financial crisis: Hong Kong took the first place then. In 2005

the connectivity of top ten airports varied from 142.45 to 489.18 while the range was between

269.81 and 2045.01 in 2016. China’s three gateway cities experienced the largest increases.

Table 2: The top ten transfer hubs between China and Australia from 2005 to 2016.

2005

Centrality

2008

Centrality

2011

Centrality

2014

Centrality

2016

Centrality

Guangzhou

489.18

Hong Kong

718.80

Guangzhou

1382.01

Guangzhou

1782.26

Guangzhou

2045.01

Sydney 267.14 Guangzhou 431.85 Hong Kong 825.85

Shanghai

Pudong

990.43 Beijing 1279.97

Hong Kong 250.64

Tokyo

Narita

362.72 Beijing 694.32 Hong Kong 855.37

Shanghai

Pudong

1099.44

Kuala

Lumpur

232.69

Seoul

Incheon

353.38

Shanghai

Pudong

655.87 Beijing 739.68 Hong Kong 860.96

Tokyo

Narita

220.84

Shanghai

Pudong

334.16

Seoul

Incheon

436.66

Seoul

Incheon

490.78

Seoul

Incheon

560.29

Seoul

Incheon

207.51 Beijing 333.31 Sydney 358.25 Bangkok 381.89 Sydney 530.06

Singapore

202.54

Sydney

318.39

Singapore

244.66

Sydney

380.82

Taipei

455.85

Bangkok

182.43

Singapore

258.68

Bangkok

208.39

Singapore

305.43

Singapore

404.68

Shanghai

Pudong

171.80

Kuala

Lumpur

216.31

Kuala

Lumpur

196.29

Kuala

Lumpur

304.84 Bangkok 382.28

Brisbane

142.45

Bangkok

178.47

Melbourne

173.57

Taipei

288.05

Chengdu

269.81

19

Figure 9: Centrality map of major transfer hubs between Australia and China in 2005.

20

Figure 10: Centrality map of major transfer hubs between Australia and China in 2016

21

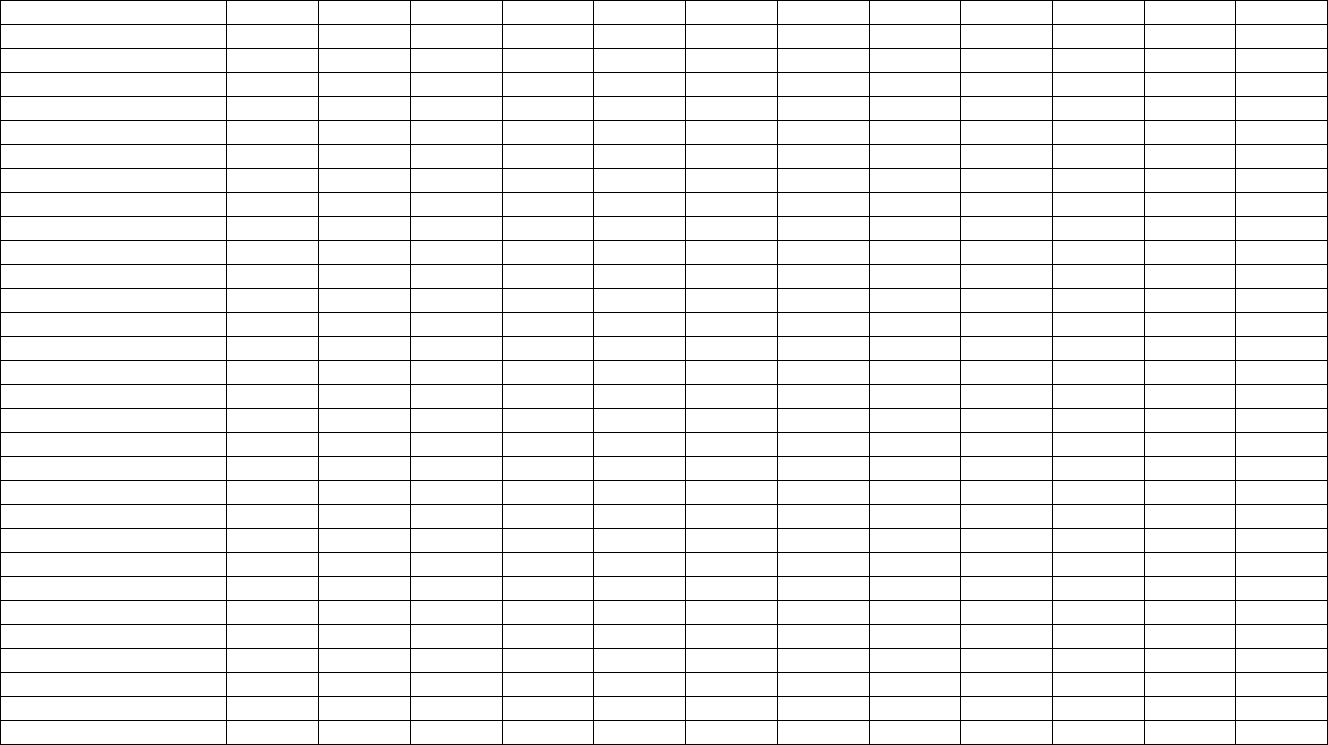

Figure 11 presents the evolution of the centrality of the major transfer hubs between Australia

and China for the period 2005–16. It can be seen that Guangzhou secured its strong status as

a transfer hub through China Southern’s services. The gaps between Guangzhou and the other

transfer hubs widened after 2010. China Southern began an aggressive marketing campaign

in 2009 and increased its flight routes to all major Australian capital cities, including

Adelaide, Brisbane and Perth. In 2012 China Southern signed a strategic cooperation

agreement with Tourism Australia to build the ‘Canton Route’ – the route connecting Europe,

Asia and Australia. From 2012 to 2016 the number of transit passengers using the ‘through

check-in’ service increased from 458,000 to 1.74 million and the ‘through checked’ bags

increased from 481,000 to 2.02 million. All these actions stimulated the demand for China

Southern’s services to Australia and secured its leading role in the China–Australia market,

thereby strengthening Guangzhou’s transfer hub status (China Southern, 2018).

Both Hong Kong and Guangzhou are located in the south of China. This strategic location

has made them ideal transfer points for passengers travelling between China and Australia. It

can be seen that Hong Kong, a traditional transit hub for Chinese travelling to Australia, has

maintained a quite stable level of centrality since 2007. It is still an ideal transfer hub,

considering its convenient airport facilities and Cathay Pacific’s extensive network (Tsui et

al., 2017). In 2016, about 13% of the passengers travelling from China to Australia made a

transfer at Hong Kong. Compared with China’s main airports, including Beijing, Shanghai

and Guangzhou, the transfer procedures and signs at Hong Kong Airport are much clearer

and easier to follow. Cathay Pacific and its wholly owned subsidiary, Cathay Dragon, operate

flights to and from many first and second tier cities in China and transport the passengers to

other parts of the world via Hong Kong. Air China and Cathay Pacific have a cross

shareholding structure: Air China owns 30% of Cathay Pacific and Cathay Pacific has 18% of

Air China. Cathay Pacific can take advantage of its alliance with Air China to continue to

strengthen Hong Kong’s hub status.

22

Figure 11: Evolution of the hub connectivity (vertical axis) of major transfer hubs between

Australia and China, 2005–16.

After 2010 Shanghai Pudong Airport was in the second or third place as a transfer hub.

However, given that the calculation of connectivity for Shanghai Pudong does not include

Shanghai Hongqiao Airport, the actual level of centrality of Shanghai Pudong should be

higher than that presented in Table 2. Shanghai-based China Eastern and Qantas have had a

codesharing agreement for a long time. In 2014 the Australian antitrust body approved the

two carriers setting up a joint venture that allows them to coordinate schedules and pricing as

well as the use of airport facilities such as lounges. The strong partnership between China

Eastern and Qantas has strengthened Shanghai Pudong’s hub status as it offers greater

convenience for passengers travelling to their final destinations via Shanghai. However, the

lack of fast and reliable connections between Shanghai Hongiqao and Shanghai Pudong

Airports may impede the further development of Shanghai Pudong into a transfer hub as most

domestic flights depart from and arrive in Shanghai Hongqiao. One solution, which is being

considered, is to construct a high-speed railway between the two airports.

Singapore is a natural choice as a transfer point because of its geographic location and close

economic links with China and Australia. As a result, it remained in the top ten transfer hubs

during the study period. In 2010 the ASEAN-China Air Transport Agreement was signed to

establish an unlimited air service arrangement (passengers and cargo) between China and

0

500

1000

1500

2000

2500

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Guangzhou Beijing Shanghai Pudong Hong Kong Seoul Incheon Sydney

23

members of the Association of Southeast Asian Nations (ASEAN), which has helped boost

the air services between China and Singapore. It is expected that Singapore will remain an

important transfer hub with the open skies arrangement.

It is worth noting that Korean airlines seized the opportunity in the last decade or so to

operate flights to many Chinese medium-sized cities and to transport Chinese passengers to

international destinations, including Australia, via Seoul. Korean airlines offer very

competitive prices, which have attracted passengers from north and northeast China. It is

expected that Seoul will continue to be a significant transfer hub for Chinese passengers in

the immediate future, given the close economic and cultural ties between the two countries

and especially considering that Korea has been actively seeking an open skies agreement with

China to strengthen Seoul’s hub status.

Any Chinese airline wanting to launch a service from a China to Australia would consider

Sydney as the first destination. It is, therefore, not surprising to see that Sydney has been

consistently ranked as a key transfer hub. The China–Australia open skies agreement is the

catalyst for the continual growth in air passenger traffic between the two countries. Sydney

Airport has some constraints that restrict its transfer hub status. A flight curfew is one

example: it means an effective closure of the airport between 11 p.m. and 6 a.m. daily. The

airport is also restricted to a maximum of 80 aircraft movements per hour (i.e., 20 every 15

minutes) between 6 a.m. and 11 p.m.: again, this limits traffic growth.

5. Conclusion and implications

This paper has adopted a connectivity model to measure direct and indirect air connectivity

between China and Australia, taking into consideration factors such as capacity, velocity and

the quality of transfer. Compared with other connectivity measures, the proposed ConnUM

incorporated more service quality dimensions and, therefore, can better reflect the quality and

quantity of the air service provisions of a city, pairs of cities and intercity networks.

In the case of China and Australia, our direct connectivity measure shows that Sydney was in

a leading position throughout the study period. This is not surprising as many Chinese

immigrants and students choose to live and study in Sydney. Visiting friends and relations

was significant part of air travel between Australia and China (O’Connor and Fuellhart,

2014). For Chinese cities, Shanghai Pudong led in direct connectivity prior to 2011, followed

24

by Guangzhou and Beijing. However, Guangzhou surpassed Shanghai Pudong from 2011 and

became the best connected Chinese city with Australia.

For overall connectivity, Australia’s gateway cities’ (Sydney and Melbourne) have much

higher connectivity than their Chinese counterparts (Beijing, Shanghai and Guangzhou). In

China, the connectivity scores of gateway cities were on average two to three times higher

than those of most secondary cities in 2016. In contrast, Sydney’s overall connectivity was

four to fourteen times as high as that of some capital cities such as Perth and Adelaide. This

may suggest that air transport in China has become more dispersed than in Australia. In fact,

from 2005 to 2016, the dominant role of Sydney and Melbourne in terms of their ability to

attract new air services substantially strengthened, suggesting a certain degree of inertia in the

overall geography of Australia’s air transport. O’Connor et al. (2018) attribute such

geographic inertia to airlines’ preference to basing their organisations and operations in large

cities. As a result, LEK (2017) found that there is limited Chinees dispersion of visitors

beyond Australian east coast cities, due in part to the lack of iconic attractions and Mandarin

translation services.

The concentration and geographic inertia of air services may limit the the policy to change

the spatial distribution of income and opportunity from large cities to regional areas

(O’Connor et al., 2018). For example, the overcrowding problem in Sydney and Melbourne

has elicited much debate as to how to move people from large cities to regional areas. One

proposal suggests that new migrants should stay in the regions for five years before they can

move to big cities. However, any proposals of this kind need to consider the role of air

services. This research finds that Australia’s small cities have a quite low air connectivity

with China, suggesting that they do not have a sufficient number of flights to the major hubs.

Wang et al. (2019) claim that economic activities in regional areas is more sensitive to the

development of the airline industry. Therefore, the effective policy implementation of

shifting people from Sydney and Melbourne should consider support measures in increasing

regional airports’ connectivity with the outside world.

This is the first research that examines the connectivity of the major hub airports for

passenger travel between China and Australia. The results of this research have significant

policy implications for aviation authorities and airport managements in terms of developing

and defending an airport’s hub status of. Guangzhou has forged its status as an emerging

25

transfer hub thanks to the quick expansion of China Southern, suggesting that an airport’s

home airline is the key driver in growing an airport’s connectivity. Hong Kong’s hub status

can be further strengthened by cooperation between Cathay Pacific and its Chinese strategic

partners. When a city has two airports, constructing a high-speed transport link and

coordinating flight schedules between them will enhance the city’s overall connectivity.

Shanghai’s air connectivity would be much higher if a high-speed railway could link its two

airports. When Beijing’s second airport opens in 2019, the same issue will arise. Finally,

open skies arrangements for Singapore, South Korea and Malaysia with China and Australia

could help retain the transfer hub status of Singapore, Seoul and Kuala Lumpur, respectively,

with those two countries. Similar strategies could be used by other airports in this region to

build their hub status.

Acknowledgement

The authors wish to thank Professor Kevin O’Connor, and the anonymous reviewers for their

insightful comments and constructive suggestions.

References

Adey, P., Budd, L., & Hubbard, P. 2007. Flying lessons: exploring the social and cultural

geographies of global air travel. Progress in Human Geography, 31(6), 773–91.

Alderighi, M., Cento. A., Nijkamp, P., & Rietveld, P. 2007. Assessment of new hub-and-

spoke and point-to-point airline network configurations. Transport Reviews, 27, 529–

49.

Banno, M., & Redondi, R. 2014. Air connectivity and foreign direct investments: economic

effects of the introduction of new routes. European Transport Research Review, 6,

355–63.

Baker, D., Merkert, R., & Kamruzzaman, M. 2015. Regional aviation and economic growth:

cointegration and causality analysis in Australia. Journal of Transport Geography, 43,

140-150

Basile R., Benfratello, L., & Castellani, D. 2006. Attracting foreign direct investments in

Europe: are Italian regions doomed? In: Malagarini, M., & Piga, G (eds) Capital

Accumulation Productivity and Growth. Palgrave Macmillan, Monitorino.

Blonigen, B. A., & Cristea, A. D. 2015. Air service and urban growth: Evidence from a

quasi-natural policy experiment. Journal of Urban Economics, 86, 128-146.

26

Bowen, J.T. 2010. The economic geography of air transportation: space, time, and the

freedom of the sky. Routledge.

Burghouwt, G., & Hakfoort, J. 2001. The evolution of the European aviation network, 1990–

1998. Journal of Air Transport Management, 7(5), 311-318.

Burghouwt, G., & Redondi, R. 2013. Connectivity in air transport networks: an assessment of

models and applications. Journal of Transport Economics and Policy, 47(1), 35–53.

Button, K., & Taylor, S. 2000. International air transportation and economic development.

Journal of Air Transport Management, 6(4), 209–22.

Calatayud, A., Palacin, R., Mangan, J., Jackson, E., & Ruiz-Rua, A. 2016. Understanding

connectivity to international markets: a systematic review. Transport Reviews, 36(6),

713–36.

China Southern, 2018. China Southern uses Terminal 2 at Guangzhou Baiyun International

Airport. Available at

https://www.csair.com/cn/about/news/recommend_news/1ce592g1vqb7h.shtml.

Coldren, G.M., Koppelman, F.S., Kasturirangan, K., & Mukherjee, A. 2003. Modeling

aggregate air-travel itinerary shares: logit model development at a major US airline.

Journal of Air Transport Management, 9(6), 361–69.

Cristea, A. D. 2011. Buyer-seller relationships in international trade: Evidence from US

States' exports and business-class travel. Journal of International Economics, 84, 207-

220.

Derudder, B., & Witlox, F. 2014. Global cities and air transport. In

A. Goetz, L. Budd (Eds.), Geographies of Air Transport, Ashgate, Farnham, Surrey,

pp. 103-123.

De Wit, J., Veldhuis, J., Burghouwt, G., & Matsumoto, H. 2009. Competitive position of

primary airports in the Asia-Pacific rim. Pacific Economic Review, 14(5), 639–50.

Fuellhart, K., & O'Connor, K. 2013. Air services at Australian cities: change and inertia

2005–2010. Geographical Research, 51(1), 37-48.

Gao, Y., & Koo, T.T., 2014. Flying Australia–Europe via China: a qualitative analysis of the

factors affecting travelers' choice of Chinese carriers using online comments data.

Journal of Air Transport Management, 39, 23–9.

Goetz, A. R., & Sutton, C. J. 1997. The geography of deregulation in the US airline

industry. Annals of the Association of American Geographers, 87(2), 238-263.

27

Hadas, Y., Gnecco, G., & Sanguineti, M. 2017. An approach to transportation network

analysis via transferable utility games. Transportation Research Part B:

Methodological, 105, 120–43.

Huang, J., & Wang, J. 2017. A comparison of indirect connectivity in Chinese airport hubs:

2010 vs. 2015. Journal of Air Transport Management, 65, 29–39.

Jennings, R. 2018. China wins it fight over flights with rival Taiwan. Forbes, 25 January

2018.

Keeney, R.L. 1974. Multiplicative utility functions. Operations Research, 22(1), 22–34.

LEK 2017. The China Tourism Economy: Reaching Australia’s Potential. Australia and

China Business Council. Melbourne. Available at

http://acbc.com.au/admin/images/uploads/Copy5L.E.K.ChinaTourism2017FINAL.pdf.

Li, K.X, & Qi, G. 2016. Transport connectivity and regional development in China. Journal

of International Logistics and Trade, 14(2), 142–55.

Liu, X., Derudder, B., & García, C. G. 2013. Exploring the co-evolution of the geographies

of air transport aviation and corporate networks. Journal of Transport Geography, 30,

26-36.

Malighetti, P., Paleari, S., & Redondi, R. 2008. Connectivity of the European airport

network: “self-help hobbing” and business implications. Journal of Air Transport

Management, 14(2), 53–65.

Márquez-Ramos, L., Martínez-Zarzoso, I., Pérez-García, E., & Wilmsmeier, G. 2011.

Maritime networks, services structure and maritime trade. Networks and Spatial

Economics, 11(3), 555–76.

Matsumoto, H. 2004. International urban systems and air passenger and cargo flows: some

calculations. Journal of Air Transport Management, 10(4), 239–47.

Matsumoto, H. 2007. International air network structures and air traffic density of world

cities. Transportation Research Part E: Logistics and Transportation Review, 43(3),

269–82.

Matsumoto, H., Domae, K., & O’Connor, K. 2016. Business connectivity, air transport and

the urban hierarchy: A case study in East Asia. Journal of Transport Geography, 54,

132–39.

Moreno, R., & López-Bazo, E. 2007. Returns to local and transport infrastructure under

regional spillovers. International Regional Science Review, 30(1), 47–71.

28

Ng, A. K., Jiang, C., Li, X., O'Connor, K., & Lee, P. T. W. 2018. A conceptual overview on

government initiatives and the transformation of transport and regional

systems. Journal of Transport Geography, 71, 199-203.

O’Connor, K. B. 1998. The International Air Linkages of Australian Cities, 1985–

1996. Australian Geographical Studies, 36(2), 143-155.

O’Connor, K. 2010. Global city regions and the location of logistics activity. Journal of

Transport Geography, 18(3), 354-362.

O’Connor, K. 2018. The differential role of cities in China-Australia connections 2001-2016.

Presented at Annual Meeting of the Association of Australia Studies in Japan,

University of Tsukuba, Japan, June 2018.

O’Connor, K. & Fuellhart, K. 2012. Cities and air services: the influence of the airline

industry. Journal of Transport Geography, 22, 46–52.

O’Connor, K. & Fuellhart, K. 2014. The transport georgraphies of the Asia Pacific. In

A. Goetz, L. Budd (Eds.), Geographies of Air Transport, Ashgate, Farnham, Surrey,

Chapter 11, pp. 187-210.

O’Connor, K., & Fuellhart, K. 2015. The fortunes of air transport gateways. Journal of

Transport Geography, 46, 164-172.

O'Connor, K., Derudder, B., & Witlox, F. 2016. Logistics services: Global functions and

global cities. Growth and Change, 47(4), 481-496.

O’Connor, K., Fuellhart, K., & Zhang, S. 2018. Change in the role of cities in China’s air

transport 2005–2015. Asian Geographer, 1-14.

Redondi, R., Malighetti, P., & Paleari, S. 2011. Hub competition and travel times in the

worldwide airport network. Journal of Transport Geography, 19, 1260–71.

Statista. (2018) Cruising speeds of the most common types of commercial airlines. Available

at https://www.statista.com/statistics/614178/cruising-speed-of-most-common-

airliners/, Suau-Sanchez, P., & Burghouwt, G. 2012. Connectivity levels and the

competitive position of Spanish airports and Iberia's network rationalization strategy,

2001–2007. Journal of Air Transport Management, 18, 47–53.

Tsui, K. W. H., Yuen, A. C. L., & Fung, M. K. Y. 2018. Maintaining competitiveness of

aviation hub: Empirical evidence of visitors to China via Hong Kong by air

transport. Current Issues in Tourism, 21(11), 1260-1284.

Van De Vijver, E., Derudder, B., & Witlox, F. 2014. Exploring causality in trade and air

passenger travel relationships: the case of Asia-Pacific, 1980–2010. Journal of

Transport Geography, 34, 142-150.

29

Veldhuis, J. 1997. The competitive position of airline networks. Journal of Air Transport

Management, 3(4), 181–88.

Vowles, T.M. 2001. The “Southwest Effect” in multi-airport regions. Journal of Air

Transport Management, 7(4), 251–58.

Wang, J., Mo, H., & Wang, F. 2014. Evolution of air transport network of China 1930–

2012. Journal of Transport Geography, 40, 145-158.

Wang, Y., Hao, C., & Liu, D. 2019. The spatial and temporal dimensions of the

interdependence between the airline industry and the Chinese economy. Journal of

Transport Geography, 74, 201-210.

Wei, Y. D. (2013). Regional development in China: states, globalization and inequality.

Routledge.

Wei, W. & Hansen, M. 2005. Impact of aircraft size and seat availability on airlines’ demand

and market share in duopoly markets. Transportation Research Part E: Logistics and

Transportation Review, 41(4), 315–27.

Williams, A. (2009). Contemporary Issues Shaping China’s Civil Aviation Policy: Balancing

International with Domestic Priorities. Routledge.

Wilmsmeier, G., & Hoffmann, J. 2008. Liner shipping connectivity and port infrastructure as

determinants of freight rates in the Caribbean. Maritime Economics & Logistics, 10(1-

2), 130–51.

Wu, W., Dong, Z., 2015. Exploring the geography of China’s airport networks: a hybrid

complex-network approach. SERC discussion paper 173, Spatial Economics Research

Centre, UK.

Zeigler, P., Pagliari, R., Suau-Sanchez, P., Malighetti, P., & Redondi, R. 2017. Low-cost

carrier entry at small European airports: low-cost carrier effects on network

connectivity and self-transfer potential. Journal of Transport Geography, 60, 68–79.

Zhang, A. 2012. Airport improvement fees, benefit spillovers, and land value capture

mechanisms. In: Ingram, G.K. & Hong, Y-H (eds), Value Capture and Land Policies,

pp. 323–48, Cambridge, MA: Lincoln Institute of Land Policy.

Zhang, Y., & Lu, Z. 2013. Low Cost Carriers in China and its Contribution to Passenger

Traffic Flow. Journal of China Tourism Research, 9(2), 207-217

Zhang, Y., & Peng, Y. 2014. Understanding travel motivations of Chinese tourists visiting

Cairns, Australia. Journal of Hospitality and Tourism Management, 21, 44–53.

30

Zhang, Y., & Round, D. K. 2008. China's airline deregulation since 1997 and the driving

forces behind the 2002 airline consolidations. Journal of Air Transport

Management, 14(3), 130-142.

Zhang, Y., Zhang, A., Zhu, Z. & Wang, K. 2017. Connectivity at Chinse airports: the

evolution and drivers. Transportation Research Part A: Policy and Practice, 103, 490–

508.

Zheng, Y., T. Chen, J. Cai, & Liu, S. 2009. Regional concentration and region-based urban

transition: China’s mega-urban region formation in the 1990s. Urban

Geography, 30(3), 312–333.

Zhu, Z., Zhang, A., & Zhang, Y. 2018. Connectivity of intercity passenger transportation in

China: A multi-modal and network approach. Journal of Transport Geography, 71,

263-276,

31

Appendix 1: Overall air connectivity (direct and indirect connectivity) of Australian airports.

Airport

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Sydney

929.92

1090.10

1195.62

1413.57

835.86

1887.04

2135.96

2431.86

2593.29

2922.04

3011.50

3905.72

Melbourne

410.14 428.10 501.19 750.63 530.42 1086.57 1437.21 1542.76 1667.23 1795.22 2134.56 2531.19

Brisbane

253.35

278.05

409.24

433.94

200.18

586.14

863.41

990.76

1086.61

1142.59

1296.97

1456.86

Perth

171.49 180.43 221.95 282.13 257.14 329.82 457.36 621.03 663.56 720.07 861.46 887.87

Cairns

96.87

96.95

160.08

166.82

40.61

134.19

119.09

191.30

215.51

156.61

177.13

333.52

Adelaide

85.46 98.68 148.87 197.45 44.88 186.41 211.46 224.55 253.92 251.99 267.43 272.25

Gold Coast

20.74

26.57

24.57

33.42

27.96

59.10

58.30

70.02

85.45

84.42

91.77

146.78

Canberra

16.17 26.05 24.84 20.14 11.93 24.92 24.49 31.65 32.42 36.55 33.91 70.70

Darwin

11.83

12.21

13.39

16.45

10.25

17.11

21.47

31.92

47.79

53.14

48.54

56.46

Hobart

11.62 12.94 14.31 17.76 10.13 22.86 25.67 22.67 25.37 23.88 24.34 39.90

Launceston

4.65

5.46

5.77

7.21

5.52

14.65

15.54

14.33

17.47

22.25

20.48

28.41

Tamworth

6.07 10.75 11.33 8.50 4.75 15.41 12.47 16.03 14.27 14.37 14.74 24.02

Wagga Wagga

7.23

11.74

13.15

10.15

5.80

12.05

12.74

14.42

12.74

18.04

17.28

22.86

Albury

7.72 13.25 12.90 11.74 4.71 13.16 14.27 14.66 14.42 16.63 13.77 22.24

Dubbo

6.25

10.46

11.46

7.69

4.62

11.44

10.33

10.74

13.06

14.28

13.25

21.24

Armidale

4.33 7.31 9.52 8.30 4.95 9.47 8.88 9.23 11.16 13.97 12.45 17.10

Newcastle

3.40

4.03

4.76

4.47

2.51

6.22

9.02

9.45

11.63

10.47

12.49

16.76

Townsville

1.93 2.26 1.90 2.61 1.21 3.83 6.26 7.99 8.02 7.33 9.88 15.50

Toowoomba

7.81

14.88

Melbourne Avalon

4.92 6.52 7.78 9.22 3.48 6.87 7.61 5.89 6.30 8.55 8.18 13.24

Mildura

1.22

1.14

1.81

3.04

1.99

5.69

6.38

6.10

7.40

8.62

10.05

11.63

Ballina

3.48 4.37 3.62 4.69 2.22 4.70 5.29 5.68 5.97 7.35 7.38 11.47

Devonport

0.91

0.62

1.33

2.70

1.81

5.70

6.07

6.20

6.75

7.82

9.53

10.21

Moree

0.62 1.44 1.61 1.77 1.44 3.77 4.69 4.25 1.63 5.80 6.33 7.78

Mackay

0.50

0.45

0.96

1.49

0.78

3.04

5.00

5.24

8.38

7.11

7.69

7.38

32

Appendix 2: Overall air connectivity (direct and indirect connectivity) of Chinese airports.

Airport

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Shanghai Pudong

378.16

378.57

466.57

454.08

302.23

542.18

530.97

611.40

601.44

636.13

627.60

672.32

Beijing

225.78

338.42

320.25

339.64

223.47

380.74

450.53

420.08

431.60

467.50

537.06

655.43

Guangzhou

237.49

272.68

277.82

265.95

174.04

378.42

445.41

501.25

524.19

549.78

591.20

617.96

Chengdu

69.38

70.18

79.78

138.47

78.38

187.84

195.15

203.49

239.66

268.93

262.83

350.81

Xiamen

86.46

91.85

115.28

136.70

104.46

154.84

163.07

160.17

185.90

190.89

201.98

284.27

Nanjing

51.58

56.44

70.95

92.54

52.50

107.19

140.15

148.83

199.53

199.97

213.56

258.47

Xi’an

37.43

54.43

53.24

64.55

31.56

80.26

99.95

140.23

147.26

161.57

196.97

250.97

Qingdao

64.43

67.49

128.06

150.07

63.19

125.22

137.13

143.28

163.33

172.14

183.14

235.63

Changsha

9.23

29.15

55.57

74.16

42.94

88.85

128.12

134.25

141.24

164.37

205.20

233.27

Shenzhen

38.54

35.02

35.34

46.16

22.25

58.34

95.12

84.32

111.06

138.25

161.60

224.70

Chongqing

40.07

45.81

49.60

76.89

42.98

96.43

103.78

108.39

110.35

152.45

177.87

221.60

Fuzhou

29.36

25.77

41.15

59.49

46.69

81.40

102.24

109.46

133.55

143.39

158.60

219.87

Kunming

68.28

73.35

87.52

106.98

50.88

110.85

141.31

174.02

179.99

190.62

189.87

210.54

Hangzhou

58.52

51.56

96.33

129.74

59.91

112.54

122.36

118.18

126.97

140.13

157.42

204.83

Wuhan

23.30

29.08

50.65

67.94

39.75

87.43

100.75

124.65

146.61

150.61

167.26

203.73

Dalian

60.56

68.85

131.22

145.66

63.29

146.80

146.21

160.63

157.01

163.67

153.53

184.51

Zhengzhou

21.80

21.08

28.26

36.99

25.19

68.33

86.84

96.68

121.25

132.69

150.04

183.52

Ningbo

26.46

23.05

37.47

52.60

37.03

79.71

98.07

121.79

98.46

99.23

122.51

156.80

Shenyang

51.18

58.63

66.92

72.19

40.31

96.90

99.71

110.62

111.23

120.38

122.43

156.78

Tianjin

33.12

35.09

48.85

54.70

31.35

81.70

87.24

103.94

90.59

99.81

119.00

145.61

Haikou

29.85

41.21

50.82

70.12

36.65

62.34

72.93

96.40

93.37

101.37

107.58

139.23

Shanghai Hongqiao

16.11

15.97

17.33

21.35

9.19

49.40

72.27

73.46

74.05

77.90

88.66

138.13

Nanning

18.96

23.62

28.85

35.71

19.85

55.41

73.61

67.51

83.26

94.50

94.87

129.28

Hefei

7.11

10.14

10.64

14.73

12.96

46.93

61.72

68.12

74.28

74.56

98.88

124.75

Changchun

13.00

15.97

25.84

42.45

29.52

70.72

78.28

87.88

95.70

97.69

108.36

122.30

Taiyuan

13.29

15.50

17.95

18.74

9.05

30.15

54.60

77.77

78.75

85.68

95.01

114.58

Shantou

20.55

20.97

27.73

38.27

23.36

59.62

71.73

76.00

68.62

76.06

100.15

112.21

Sanya

25.96

25.44

24.73

39.63

21.99

60.24

75.64

87.87

100.60

103.46

100.60

111.00

Guiyang

31.03

31.57

34.48

45.78

30.96

58.56

70.16

69.55

73.22

83.11

88.45

110.01

Jinan

18.51

20.42

18.34

25.41

9.23

36.95

45.82

51.79

65.74

75.22

87.30

107.33