FISCAL YEAR ENDING

JUNE 30, 2023

ACCOUNTS RECEIVABLE

MANAGEMENT REPORT

i

Department of Administrative Services

Chief Financial Office

155 Cottage Street NE

Salem, OR 97301

PHONE: 503-378-3106

FAX: 503-373-7643

January 31, 2024

To the members of the Oregon Legislative Assembly,

Enclosed is the Statewide Accounts Receivable Management Report as required by Oregon

Revised Statute 293.252(1)(e). The report identifies important issues and significant trends in

state agency debt collection practices and describes efforts by state agencies to improve the

collection of liquidated and delinquent debt. This is the eighth report issued under the statute

mentioned above.

The following report and appendices reference liquidated and delinquent account activity

reported by state agencies for the fiscal year ending June 30, 2023.

Sincerely,

Kate Nass

Chief Financial Officer

Fiscal Year 2023 Statewide Accounts Receivable Management Report

ii

EXECUTIVE SUMMARY

As required by ORS 192.245 (2), this report is available online at:

HTTPS://WWW.OREGON.GOV/DAS/FINANCIAL/ACCTNG/PAGES/PUB.ASPX.

Liquidated and delinquent (L&D) accounts collections statewide in fiscal year (FY) 2023 were

$455.7 million, a decrease of $10.1 million (2.2%) compared to FY 2022. Executive Branch

agencies collected $377.5 million, a decrease of $19.4 million (4.9%) compared to FY 2022.

The statewide ending balance of L&D accounts

receivable for FY 2023 was $3.5 billion, a 5.1%

increase from FY 2022. Executive Branch agencies

accounted for 52.9% of the statewide ending

balance.

Statewide agencies reported that $1.8 billion

(52.6% of the ending balance) L&D accounts were

doubtful to ever be collected. While considered

doubtful to be collected, these accounts continue

to receive collection efforts until either a payment is received, the account is determined to be

uncollectible according to state policy, or the account is canceled in accordance with statute.

This leaves $1.7 billion in net L&D accounts receivable.

Executive Branch agencies reported $109.6 million in accounts that were unassigned, non-

exempt, and without a payment in more than 90 days, a $22.8 million increase compared to FY

2022.

Some agencies continue to be challenged with data integrity issues, and has resulted in

difference between data reported to LFO and to DAS in the ARPM, which are separate

reporting requirements under ORS 293.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

iii

TABLE OF CONTENTS

Background ........................................................................................................................... 1

Statewide Efforts to Improve Collections ............................................................................... 1

Accounts Receivable Performance Measures ............................................................................ 1

Vendor Coordination ..................................................................................................................... 4

Training .......................................................................................................................................... 5

Accounts Receivable Honor Roll .................................................................................................. 6

SWARM Efforts .............................................................................................................................. 6

Data Analysis ......................................................................................................................... 8

Liquidated and Delinquent Account Analysis by Branch............................................................. 8

Executive Branch Liquidated and Delinquent Accounts ............................................................. 9

Changes in Liquidated and Delinquent Account Balances ....................................................... 10

Unassigned Accounts Over 90 Days .......................................................................................... 16

Future of State Debt Collections ........................................................................................... 17

Acknowledgments ............................................................................................................... 17

Appendix A – Accounts Receivable Management Overview ................................................. 18

How the State Collects Debt ....................................................................................................... 18

Collection Issues and Challenges .............................................................................................. 22

Statewide Accounts Receivable Management .......................................................................... 24

Factors in Collecting Accounts Receivables.............................................................................. 25

Collection Tools ........................................................................................................................... 29

Appendix B – LFO Data by Branch of Government ................................................................ 32

Appendix C – Glossary of Terms .......................................................................................... 34

Appendix D – Accounts Receivable Honor Roll ..................................................................... 36

Appendix E – Executive Branch State Agency Compliance with ORS 293.231 ...................... 41

Fiscal Year 2023 Statewide Accounts Receivable Management Report

1

BACKGROUND

As required by Oregon Revised Statute (ORS) 293.252(1)(e), the Department of Administrative

Services (DAS) hereby submits the annual Statewide Accounts Receivable Management Report

to the Legislative Assembly in conjunction with the Legislative Fiscal Office’s (LFO) Report on

Liquidated and Delinquent Accounts Receivable. This report identifies important issues and

significant trends in Executive Branch agency debt collection practices and describes efforts

by those agencies to improve the collection of delinquent debt.

The accounts receivable data referenced in this report represents liquidated and delinquent

(L&D) accounts as of June 30, 2023, as reported by state agencies to LFO. The accounts

include debts owed to state agencies by an individual or entity in which the debt was not paid

by the original due date and the debtor was notified of the debt and given an opportunity to

dispute the debt.

For reference purposes, background information about state agency collection processes and

challenges are provided in the Accounts Receivable Management Overview (Appendix A), the

LFO Data by Branch of Government (Appendix B), and the Glossary of Terms (Appendix C)

provides definitions of terms that are bold in this report. The agencies who earned recognition

of the Accounts Receivable Honor Roll for Fiscal Years (FY) 2022, 2021, and 2020 are listed in

Appendix D. Executive Branch agencies’ compliance with the statutory requirement to assign

L&D accounts to the Department of Revenue Other Agency Accounts Unit (DOR-OAA) in FY

2023 are reported in Appendix E.

STATEWIDE EFFORTS TO IMPROVE COLLECTIONS

Since the establishment of the Statewide Accounts Receivable Management (SWARM) team in

2016, policy and legislative changes have raised awareness and focus on accounts receivable

management and the changes are now part of state agency procedures to collect delinquent

accounts receivable.

ACCOUNTS RECEIVABLE PERFORMANCE MEASURES

The Department of Administrative Services (DAS) Chief Financial Office established Oregon

Accounting Manual (OAM) policy 35.60.20, which requires most Executive Branch state

agencies to track performance measures related to accounts receivable management and

Fiscal Year 2023 Statewide Accounts Receivable Management Report

2

report progress quarterly and annually.

1

These measures and agency targets were designed to

bring attention to accounts receivable practices within the agencies so they can better manage

those practices and improve them.

The quarterly Accounts Receivable Performance Measures (ARPM) requires state agencies to

report:

• Total accounts receivable collections;

• Liquidated and delinquent (L&D) accounts receivable collections;

• Outstanding accounts receivable balances; and

• Outstanding accounts receivable balances over 90 days past due.

The annual ARPM requires agencies to report:

• The number of days to collect;

• Number of days to assign; and

• Write-offs as a percentage of total available accounts receivable.

Key information for Executive Branch agencies, as reported on the ARPMs, are listed in Tables

1 and 2 below.

Table 1.

Quarterly Performance Measure: Fiscal Year 2023 Fiscal Year 2022 Fiscal Year 2021

Total accounts receivable

collections

2

$9.7 billion $9 billion $8.1 billion

L&D account collections

3

$422.4 million $433.5 million $550.5 million

Total outstanding accounts

receivable

$2.6 billion $2.5 billion $2.6 billion

Accounts receivable over 90 days

past due, as a percentage of total

outstanding accounts receivable

73.1% 71% 65.4%

1

OAM 01.05.00 documents the scope and applicability of the OAM.

2

Total accounts receivable collections include all amounts collected by the agency that are applied to an accounts receivable, including

accounts that are L&D.

3

L&D account collections reported by Executive Branch agencies on the ARPM reports should match the collections reported annually to LFO;

however, due to a variety of challenges identified on page 3, the ARPM data did not match the data reported to LFO.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

3

The increase in total accounts receivable collections ($9.7 billion from $9 billion), was

primarily the result of a change in the method of identifying and calculating the accounts

receivable collections at the Public Employees Retirement System (PERS). This change began

January 1, 2023, and resulted in an increase of $992 million. The Oregon Department of

Transportation (ODOT) reported a decrease in total collections of $182.7 million primarily due

to an overall decrease in billings to Federal agencies in FY23.

The FY 2023 combined decrease of $11.1 million in L&D account collections occurred

primarily at three agencies: PERS ($13.1 million decrease), Department of Revenue (DOR) ($13

million decrease) and the Oregon Employment Department (OED) ($16 million increase).

• PERS L&D collections in FY 2022 included a large employer-related invoice payment of

over $11 million, however FY23 did not include any such large invoices or payments.

• The decrease for DOR is due to field revenue agents returning to normal duties, ceasing

participation in a special project to issue garnishments manually (the department

paused field collection visits during the COVID-19 pandemic). To improve collection

efficiency going forward, DOR has programmed additional functionality to better target

automated garnishments and will re-implement automated garnishment during fiscal

year 2024.

• OED reported ARPM L&D collections of $100.8 million in FY 2023 ($16 million increase

over FY 2022), however, based on the agency reports to LFO, L&D collections in FY 2023

were $54.7 million ($8.6 million increase over FY 2022). OED uses data from a legacy

system to create the ARPM reports each quarter and due to the way that system stores

the data, the agency is required to make assumptions regarding the L&D status of

accounts each quarter. OED continues to expand the functionality of their new system,

and once fully implemented OED expects that the ARPM and LFO reports will match.

It is expected that agencies will see changes in outstanding receivables from one year to

another. The change in total outstanding accounts receivable from FY 2022 to FY 2023 was an

increase of $146.8 million, while the accounts receivable balance over 90 days increased by

$159.5 million, which resulted in the increase in the percentage of accounts receivable over 90

days past due.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

4

Table 2.

Annual Performance Measure: Fiscal Year 2023 Fiscal Year 2022 Fiscal Year 2021

Average % of accounts paid in full

within 60 days of the effective

date

72.6% 71.2% 66%

Average % of accounts assigned

within 90 days of meeting the

definition of L&D

56.9% 49.7%

53.7%

Write-offs, as a percentage of all

available accounts receivable

0.3% 0.3% 0.9%

There were no significant changes to the percentage of accounts paid in full within 60 days of

the effective date of the receivable when compared to FY 2022.

Overall, agencies increased the percentage of accounts assigned within 90 days of meeting

the definition of L&D compared to FY 2022. If an agency is receiving payment on an account,

ORS 293.231(1) does not require assignment until 90 days from the date of receipt of the most

recent payment on the account, therefore it is reasonable that not all accounts would be

assigned within 90 days of meeting the definition of L&D.

Executive branch agencies reported a total of $36.7 million in write-offs during FY 2023 which

was 0.3% of the available accounts receivable (beginning balance plus new receivables

established), this percentage was unchanged from FY 2022.

VENDOR COORDINATION

Vendor coordination was established during FY 2018 to intercept payments to vendors that

owed debts to the state, using an administrative hold and garnishment process. Vendor

coordination includes a daily electronic file exchange and automated data match process to

identify pending payments due to vendors that owe a debt to the state. Upon identification, the

paying state agency notifies DOR of the match and DOR determines whether a garnishment

should be issued to intercept the pending payment.

Before a state agency intercepts a pending payment, agency management must determine

whether the payment is subject to garnishment and apply good judgment and independent

thinking. A state agency may decide to not garnish a vendor payment, even if the garnishment

Fiscal Year 2023 Statewide Accounts Receivable Management Report

5

is otherwise allowed by law or regulation (for example, when garnishment of funds would be

contrary to an agency’s mission, such as garnishment of benefit or assistance payments).

Eighty-two state agencies, including Judicial Branch and Legislative Branch agencies have

been provided the ability to identify and intercept pending vendor payments to apply towards

DOR tax debts owed to the state.

Vendor Coordination recoveries totaled $585 thousand in FY 2023, a $181 thousand decrease

from FY 2022.

The total vendor offset program amount reported by agencies to LFO for FY

2023 was $541 thousand. This includes $430 thousand reported by DOR, which is the net

amount after any refunds resulting from a garnishment challenge. Additionally, the DOR

amount reported to LFO does not include $66 thousand of vendor coordination recoveries;

which were the result of a timing difference where the agency intercepted the payment in late

June but it was not received by DOR and posted to the account until July. The payments will be

included in the FY 2024 LFO report. The LFO report also includes amounts that agencies offset

from payments due to vendors that also owed a debt to that agency, these offsets are not

included in the DOR garnishment process. Due to the nature of the diverse payments made by

the state, fluctuations in recoveries from year to year are expected. State agencies have

recovered a total of $2.8 million since implementation in Jan 2018 (Fig. 1).

Figure 1.

TRAINING

Each year, SWARM evaluates the needs of state agency accounts receivable professionals to

determine the most beneficial training needed by those agencies. Understanding that state

agency accounts receivable professionals have limited time available to attend classroom

training, SWARM maximizes the use of online training. Each training is published to the

Fiscal Year 2023 Statewide Accounts Receivable Management Report

6

SWARM website

4

and SWARM encourages managers and accounting professionals

responsible for overseeing or processing accounts receivable transactions to partake in the

training opportunities.

ACCOUNTS RECEIVABLE HONOR ROLL

To recognize the efforts of accounts receivable professionals statewide, and encourage

prioritization of accounts receivable management activities, the DAS Chief Financial Office

(DAS-CFO) awards the Accounts Receivable Honor Roll to state agencies that submit accurate

reports by the required due dates and attend the required annual training

5

. Upon conclusion of

the fiscal year and all accounting related activities, DAS-CFO notifies the state agencies that

achieved this recognition and sends a certificate accompanied by a congratulatory letter

addressed to the agency’s director. Additionally, the list of Accounts Receivable Honor Roll

recipients for the previous fiscal year is published on the SWARM webpage.

In reviewing the FY 2022 reporting of the 122 agencies who were eligible to earn recognition

on the Accounts Receivable Honor Roll for FY 2022, 96 agencies (79%, the same as FY 2021)

were awarded this distinction. The full list of FY 2022 awardees is listed in Appendix D.

State agency participation in submitting accurate and timely accounts receivable reports is an

important component in meeting the statewide efforts to improve accounts receivable

management processes and the integrity of L&D account data reported annually to LFO.

SWARM EFFORTS

As directed in ORS 293.252, SWARM monitors state agency debt collection functions and

assists their efforts to improve the collection of delinquent debts. SWARM also establishes

and maintains accounts receivable policies, best practices, and trainings to facilitate timely

and accurate reporting and improving collections. These efforts raise state agency awareness

and focus on accounts receivable management.

SWARM works closely with state agency accounts receivable professionals to improve

agency-specific policies and procedures. Because state agencies tend to have accounts,

debtors, and processes that are particular to the mission of the agency, one-on-one

coordination is an essential component in helping agencies incorporate general statewide

accounts receivable management guidance into agency-specific policies and procedures.

4

https://www.oregon.gov/das/Financial/Acctng/Pages/Training.aspx, Accounts receivable training and workshops.

5

Each year SWARM distributes a list of accounts receivable reporting requirements and the respective due dates.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

7

SWARM regularly reaches out to agencies to offer one-on-one accounts receivable training at

the convenience of the agency and on topics chosen by the agency.

In FY 2024, SWARM will be using information gathered from agencies to analyze ARPM data

based on common elements such as agency function, type of receivables, customer and

primary collection tools to identify agencies with successful receivables management

practices. SWARM will meet with those agencies to learn more about their individual

processes and procedures and then share the lessons learned with agencies that have been

less successful in their receivables management to help those agencies improve their

processes and hopefully report a higher level of success in the future.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

8

DATA ANALYSIS

LIQUIDATED AND DELINQUENT ACCOUNT ANALYSIS BY BRANCH

All agencies within state government, as well as some special government entities, are

required to report L&D account activity to LFO annually.

6

Depending on whether the agency is

subject to centralization, state agencies report L&D account activity to LFO in three or four of

the following categories: total L&D accounts; accounts assigned to DOR-OAA; accounts

assigned to a private collection firm (PCF)

7

; and accounts exempt from assignment. Each of

these components are evaluated to assess the overall status of L&D account activity.

Agencies are required to report the value of L&D accounts they consider doubtful to be

collected. These doubtful accounts are still going through the collections process and could

be collected or may become eligible for write-off. The balance of L&D accounts less the

balance of doubtful accounts equals the adjusted ending balance which represents the

estimated value of L&D accounts potentially recoverable with reasonable effort over time and

using collection tools available to the state. Based on data reported to LFO by all state

agencies, $1.8 billion, or 52.6%, of L&D account balances are doubtful to ever be collected.

The LFO report does not separate L&D debt balances by branch of government. In order to

characterize where the balance of L&D debt resides, this Statewide Accounts Receivable

Management Report separates the FY 2023 data reported to LFO by branch (Table 3). Agencies

within the Legislative Branch, as well as the special government entities, are listed as “All

Others”.

8

6

ORS 293.229 and ORS 1.195 define the annual LFO reporting requirement.

7

Beginning in FY 2020, agencies subject to centralization were no longer required to report accounts assigned to a private collection firm

(PCF) since these assignments are determined by DOR-OAA.

8

Refer to Appendix D for a listing of agencies by branch of government.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

9

Table 3.

Total Liquidated and Delinquent Accounts Receivable

For the Year Ended June 30, 2023

Judicial Executive All Others Total

Beginning Balance $1,567,230,771 $1,640,843,057 $118,271,510 $3,326,345,338

Additions 131,397,857 928,161,476 55,454,648 1,115,013,981

Collections (51,102,978) (377,486,089) (27,112,035) (455,701,102)

Write-Offs

9

(19,007,812) (36,652,805) (12,649,398) (68,310,015)

Adjustments (109,329,826) (235,259,519) (7,296,060) (351,885,405)

Reversals - (70,654,271) (366,670) (71,020,941)

Ending Balance $1,519,188,012

$1,

848,951,849 $126,301,995 $3,494,441,856

Doubtful Accounts (1,265,939,371) (531,967,272) (40,719,189) (1,838,625,832)

Adj. Ending Bal. $ 253,248,641

$1,

316,984,577 $ 85,582,806 $1,655,816,024

The statewide L&D accounts receivable ending balance of $3.5 billion as of FY 2023 is

comprised predominantly of the Judicial and Executive Branches. Though the SWARM team

collaborates and provides accounts receivable management assistance to all state agencies,

only Executive Branch agencies are subject to the accounting requirements set forth by DAS

and documented in the OAM.

10

For this reason, the remainder of this analysis focuses on

account activity associated with Executive Branch agencies.

EXECUTIVE BRANCH LIQUIDATED AND DELINQUENT ACCOUNTS

Executive Branch agencies reported an L&D ending balance totaling $1.8 billion, with four

agencies representing 92% (Table 4).

11

The ending balance is a 12.7% increase from FY 2022,

as shown in Table 5, which provides more detail on the differences between the two fiscal years.

9

The total write-off amounts identified in Table 3 are $12.2 million more than the amounts reported on the FY 2023 Write Off, Abated and

Canceled Certification Report, delivered to the Joint Committee on Ways and Means on December 30, 2023, due to universities and Oregon

Health Science University which are not subject to ORS 293.234

; and do not submit write off, abated and canceled debt certifications to DAS.

10

The Judicial Branch, Legislative Branch, and special government entities are not subject to accounting policies established by DAS.

11

Refer to Appendix A for more information about the types of accounts reported by these four agencies.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

10

Table 4.

Executive Branch Agency Ending Balances

For the Year Ended June 30, 2023

Percent of

Ending Balance

Ending Balance

Department of Revenue

$ 862,708,565

46.7%

Oregon Employment Department

415,973,821

22.5%

Department of Justice

289,286,253

15.6%

Department of Consumer and Business Services

133,684,779

7.2%

Remaining agencies

147,298,431

8%

Total

$1,848,951,849

100%

CHANGES IN LIQUIDATED AND DELINQUENT ACCOUNT BALANCES

The comparison of Executive Branch agencies’ L&D accounts receivable from FY 2022 to FY

2023 helps to evaluate state agency effectiveness in managing accounts receivable over the

last year (Table 5).

Table 5.

Executive Branch Liquidated and Delinquent Accounts Receivable

Fiscal Year Comparison

2023 2022

Net Increase/

(Decrease)

12

Beginning Balance

$1,640,843,057

$1,607,541,334

$ 33,301,723

Additions

928,161,476

841,250,005

86,911,471

Collections

(377,486,089)

(396,904,444)

(19,418,355)

Write-Offs

(36,652,805)

(42,000,704)

(5,347,899)

Adjustments

(235,259,519)

(255,244,620)

19,985,101

Reversals

(70,654,271)

(113,798,514)

(43,144,243)

Ending Balance

$1,848,951,849

$1,640,843,057

208,108,792

While variation in L&D account activity from one year to the next is expected, SWARM analyzes

the data to identify the largest changes and the factors that contributed to these changes.

Below are some highlights of those changes.

12

The net increase / (decrease) reflects the difference between each row and is not intended to total.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

11

L&D additions increased by $86.9 million in FY 2023 compared to FY 2022. Three agencies

account for 97% of the change in L&D additions; DOR, OED and DAS.

• DOR additions increased by $62.6 million due primarily to the kicker credit claimed by

taxpayers on the 2021 tax returns (filed in 2022), which reduced the tax liability owed.

The tax filings in 2023 did not include a kicker credit resulting in a higher tax liability

than FY 2022. DOR additions in FY 2023 were only $15 million less than FY 2021, which

was the last year a kicker credit was available.

• OED additions increased by $39.9 million compared to FY 2022. During the pandemic,

OED experienced record numbers of overpayments, including fraud cases for the

Unemployment Insurance program. These overpayments are actively affecting

collection workload and are anticipated to continue to affect workload and backlog for

several years to come. To address this the agency is increasing staffing that will focus

on overpayment and collection processing.

• DAS additions decreased $18.3 million compared to FY 2022 as it is common for DAS

to have fewer billings for agency assessments in the second year of the biennium.

L&D collections decreased by $19.4 million compared to FY 2022 with three agencies

accounting for 90.1% of the change; DOR, PERS and OED.

• DOR collections decreased $13 million due to field revenue agents returning to normal

duties, ceasing participation in a special project to issue garnishments manually (the

department paused field collection visits during the COVID-19 pandemic). To improve

collection efficiency going forward, DOR has programmed additional functionality to

better target automated garnishments and will re-implement automated garnishments

during fiscal year 2024.

• PERS collections decreased by $13.1 million because in FY 2022 PERS collections

included a large employer related invoice payment of over $11 million while FY23 did

not include any such large payments.

• Due to the record number of overpayments, including fraud cases, for the

Unemployment Insurance program during the pandemic OED collections increased by

$8.6 million (18.6% increase over FY 2022).

The $5.3 million decrease in write-offs for Executive Branch agencies was largely associated

with three agencies that reported significant changes from FY 2022. Those three agencies are

DOR, OED and PERS and combined they account for $5.8 million in decreased write-offs.

• DOR write-offs decreased by $6.6 million compared to FY 2022, write-offs can vary from

year to year based on accounts that meet the identified criteria in the agency program

that flags accounts for write-off.

•

OED had dramatically higher call volumes and, in addition system changes impacted

various processes across the business. This has resulted in a shift of resources and a

Fiscal Year 2023 Statewide Accounts Receivable Management Report

12

reduction of the total agency write-offs by $6 million compared to FY 2022. As OED

becomes more proficient in the use of the new system, more accounts are expected to

be identified for write-off in the future.

•

PERS has recently dedicated staff resources to reviewing accounts that have been

identified as owing from a deceased debtor these efforts resulted in a $6.7 million

increase of write-offs compared to the prior year.

Adjustments can either increase or decrease debt and occur when amounts are set up

incorrectly, amounts are determined to be uncollectible (due to bankruptcy, for example) or

amounts are determined not owed (due to settlements in compromise, for example). In FY

2023 Executive Branch agencies reported adjustments that decreased debt $235.3 million, a

change of $20 million or 7.8% compared to FY 2022. The agency with the largest change

($12.8 million decrease) was ODHS which, per Federal guidance, in FY 2022 adjusted medical

overpayments (except for criminal restitution and continuation of benefits) to zero.

Reversals in FY 2023 decreased $43.1 million from FY 2022. DOR reported decreased

reversals of $33.7 million, due to in part to the decrease in additions from FY 2022 which

resulted in fewer reversals in FY 2023 for accounts such as failure to file assessments where

the taxpayer has since filed their tax return. Additionally, in FY 2022 DOR recorded reversals of

$34 million for accounts associated with an active appeal. DOR has recently changed the point

in time at which the agency issues a warrant on certain accounts that have a higher tendency

to appeal to the Oregon tax court, waiting to issue the warrant until after all statutory appeal

rights have expired. This procedural change by DOR has resulted in fewer reversals due to

accounts with an active appeal. Oregon Department of Forestry reported decreased reversals

of $9.7 million due to a one-time reporting in FY 2022 for accounts that were determined not to

meet the definition of L&D.

ORS 293.231 requires Executive Branch agencies to assign eligible accounts to DOR-OAA for

collection action.

13

Assigning accounts to DOR-OAA allows agency staff to focus on the

agency’s mission while allowing the collection specialists at DOR-OAA to focus on the

collection of the debt. For this reason, SWARM encourages state agencies to assign accounts

soon after the account meets the definition of L&D. Assignment activity varies from year-to-

year due, in part, to the type and volume of accounts that become L&D during the FY.

14

For

example, an agency may have an increase in L&D account activity due to a procedural change

which qualifies more accounts for assignment to a third-party collector. Categorical

comparisons in assignment activity (e.g. additions, returns) are not relevant when evaluating

whether agencies are effectively managing L&D accounts, since once the account is assigned

13

For more information about account assignment requirements, refer to How the State Collects Debt in Appendix A.

14

For liquidated and delinquent account assignments to DOR-OAA and PCFs by all state agencies, refer to Appendix B.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

13

the agency no longer has control over it. It should be noted that assignment activity variances

from year-to-year help identify where procedural changes may have occurred. When evaluating

whether accounts are being effectively managed, where the account resides in the collection

lifecycle provides a more informative perspective. Executive Branch agencies reported

outstanding assignments to a third-party for collection, which includes accounts at DOR-OAA

and at PCFs, action totaling $431.2 million, an increase of $73.6 million from FY 2022 (Table

6).

Table 6.

Executive Branch Liquidated and Delinquent Accounts Receivable

Fiscal Year Comparison

Assigned to Department of Revenue-Other Agency Accounts

2023 2022

Net Increase/

(Decrease)

15

Beginning Balance

$ 149,910,638

$ 145,427,345

$ 4,483,293

Additions

92,455,048

32,953,032

59,502,016

Collections

(8,709,665)

(10,535,933)

(1,826,268)

Returned to Originating Agency

(38,997,334)

(17,933,806)

21,063,528

Ending Balance

$ 194,658,687

$ 149,910,638

44,748,049

Assigned to Private Collection Firms

2023 2022

Net Increase/

(Decrease)

Beginning Balance

$207,691,722

$101,245,270

$ 106,466,452

Additions

160,470,041

211,997,197

(51,527,156)

Collections

(11,891,877)

(11,492,638)

399,239

Returned to DOR-OAA

-

(17,338)

(17,338)

Returned to Originating Agency

(119,683,679)

(94,040,769)

25,642,910

Ending Balance

$236,586,207

$207,691,722

28,894,485

DOR-OAA & PCF Ending

Balance $431,244,894 $357,602,360 73,642,534

15

The net increase/(decrease) reflects the difference between each row and is not intended to total.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

14

Under centralization, most Executive Branch agencies assign L&D accounts to DOR-OAA for

collection which may result in the account being forwarded to a PCF

16

. As of June 30, 2023,

$50.2 million (25.8%) of the accounts assigned to DOR-OAA had been assigned to a PCF.

Of the $236.6 million PCF ending balance (excludes accounts assigned by DOR-OAA), $236

million is owed to DOR for delinquent taxes.

Not all L&D accounts are subject to the assignment provisions referenced in ORS 293.231,

agencies may exempt accounts from assignment that meet an administrative or statutory

exemption criteria. A common misconception is that an exemption means the account cannot

be assigned to collections; generally, this is untrue. Rather, assignment exemptions provide

agencies the flexibility to determine alternative avenues to effectively collect a delinquent

account. For example, some state agencies have an internal collections unit combined with

unique tools which allow the agency to effectively collect its accounts. Specifically, Oregon

Department of Human Services (ODHS), DOR, ODOT, Department of Justice (DOJ), OED, and

the Oregon Health Authority (OHA) have such specialized collection units and may exempt

applicable accounts from third-party collection actions when attempting recovery through

actions such as the issuance of a distraint warrant and garnishment. For FY 2023, Executive

Branch agencies reported $1billion in accounts that are exempt from assignment, a 13.8%

increase from FY 2022 (Table 7).

Table 7.

Executive Branch Liquidated and Delinquent Accounts Receivable

Fiscal Year Comparison

Accounts Exempt from Assignment

2023 2022

Net Increase/

(Decrease)

Administrative Exemption

$ 770,323,969

$ 614,718,158

$ 155,605,811

Statutory Exemption

237,856,977

271,215,317

(33,358,340)

Total Exemptions

$ 1,008,180,946

$ 885,933,475

$ 122,247,471

Total L&D Ending

Balance $1,848,951,849 $1,640,843,057 $ 208,108,792

Exemptions as a

percentage of L&D

Ending Balance

54.5% 54% 0.5%

16

Subject to the requirements of ORS 293.231 (3)(a)

Fiscal Year 2023 Statewide Accounts Receivable Management Report

15

Three agencies reported 91% ($917.1 million) of all Executive Branch agency exemptions for

FY 2023 (Fig. 2).

Figure 2.

Of the $1 billion in total account exemptions reported in FY 2023, 78.3% were accounts

affiliated with one of four exemption categories (Fig. 3).

Figure 3.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

16

OED reported FY 2023 DAS approved exemptions of $328.2 million (92.5% of total DAS

approved exemptions), this was an increase of $152.2 million compared to FY 2022. This

increase is expected due to the total ending balance increase for OED ($141.9 million). Since

February 2017 OED requested, and DAS approved, an exemption for accounts from the

Unemployment Insurance program that are subject to a United States Department of Labor

restriction on assignments to third party collectors until such time as the state determines the

account to be uncollectible. OED could be subject to a loss of federal funding if assignments

occurred outside of the federal requirements.

The exemption for spousal/child support is reported by DOJ, the 9.5% reduction in this

exemption is related to the overall reduction (9%) in the agency’s ending balance of L&D

accounts. The DOJ Division of Child Support’s new system, Origin, has functionality that allows

creation of payment agreements with participants at receivable creation. With this

functionality, the division may recoup money before the debt reaches liquidation.

UNASSIGNED ACCOUNTS OVER 90 DAYS

Another component used to evaluate the effectiveness of state agency L&D account

management is the balance of unassigned, non-exempt accounts without a payment for 90

days or more. In FY 2023, Executive Branch agencies reported $109.6 million in accounts that

were unassigned, non-exempt without a payment for 90 days or more.

17

While this is a $22.8

million (26.3%) increase compared to the $86.8 million reported in FY 2022, the submission by

DOR ($102.1 million, or 93.2% of the total) includes $55 million in accounts that were

previously assigned to a PCF and were returned to DOR. The agency is reviewing these

accounts for possible write-off, had these not been returned by the PCF, the total unassigned

non-exempt accounts with no payments for more than 90 days would have been a decrease.

DOR also noted that $47 million in accounts that were not assigned due to an omission in the

agency system programming that identifies accounts for assignment. As a result, a group of

accounts were not assigned at the required time. DOR is working to correct the programming

and expects these accounts will be assigned in fiscal year 2024.

Of the remaining $7.5 million (6.8%) unassigned, non-exempt accounts without a payment for

90 days or more, $7.2 million (6.5%) were accounts that were subject to assignment, but the

state agency did not comply with ORS 293.231 (a $4.4 million increase from FY 2022). The

increase is mostly from Business Oregon which reported $4.7 million in unassigned accounts

without a payment for 90 days or more in FY 2023 and $0 in FY 2022. The agency reported

accounts as exempt from assignment but in FY 2023 noted that they were unable to identify

17

Refer to the 2023 LFO Report on Liquidated and Delinquent Accounts Receivable for a list of these agencies and amounts reported.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

17

why the accounts would be exempt at this time. Business Oregon has initiated an internal

review of their reporting and billing processes to improve data quality in the future. Agencies

that are not subject to the assignment requirements of ORS 293.231(7) reported $320

thousand (0.3%) unassigned, non-exempt accounts without a payment for 90 days or more.

FUTURE OF STATE DEBT COLLECTIONS

Statewide L&D collections significantly decreased starting in FY 2021 primarily due to changes

in reporting by a few agencies, as well as impacts from the COVID-19 pandemic. Collections in

FY 2022 started to increase primarily due to a large account collection at PERS and in part due

to increased offsets related to the kicker credit. Overall collections in FY 2023 returned to the

level reported in FY 2021. SWARM recognizes the continued need for training new agency staff

on the basics of debt collection in the government sector and refinement of agency’s

processes with their existing resources.

SWARM will continue to focus on collaboration across state government to implement best

practices and new technologies to improve accounts receivable management. Beginning in FY

2024 SWARM is working with agencies to use data from the ARPM and LFO reporting to

analyze agencies with higher rates of success in receivables management and identify the

agency processes that contribute to that success and share those lessons learned with

agencies that have similar functions, customers, and receivable types to improve the best

practices and overall receivables management.

ACKNOWLEDGMENTS

SWARM appreciates the access to agency L&D accounts receivable data from LFO; this report

would not be possible without LFO’s support. SWARM also extends thanks to state agencies

for staff’s professionalism and dedication to improving accounts receivable data and

collection processes.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

18

APPENDIX A – ACCOUNTS RECEIVABLE MANAGEMENT

OVERVIEW

HOW THE STATE COLLECTS DEBT

APPLICABILITY

The statutory requirements pertaining to collecting L&D debt are documented in two chapters

of the ORS based upon the applicable branch of state government. The collection and

assignment provisions of ORS Chapter 1

18

apply to agencies within the Judicial Branch and the

provisions of ORS Chapter 293 apply to agencies within the Administrative or Executive

Branch

19

. Statewide policies and procedures pertaining to accounts receivable management

are documented in OAM Chapter 35 and are applicable to Executive Branch agencies

20

subject

to report financial activity in the Annual Comprehensive Financial Report.

EXECUTIVE BRANCH AGENCIES

Agencies have an obligation to bill in a timely manner for goods provided or services rendered.

When an account is not paid by the due date, it becomes delinquent. The state agency is then

responsible for conducting collection activities and must follow a complex process based on

federal and state requirements for due process. These activities include contacting the debtor

by phone and letter to notify the debtor of the amount due and to request payment, and

administrative proceedings when a debtor disputes a debt (Fig. 4). The letters also serve to

notify the debtor of: procedures and deadlines to dispute the debt; potential interest costs;

possible account assignment to DOR-OAA; and the additional collection costs associated with

assigning the account. Letters are a common method used to liquidate an account; however,

accounts may also become liquidated as the result of: a court or administrative order; written

agreement between the state agency and the debtor; or by the debtor acknowledging the debt

in writing.

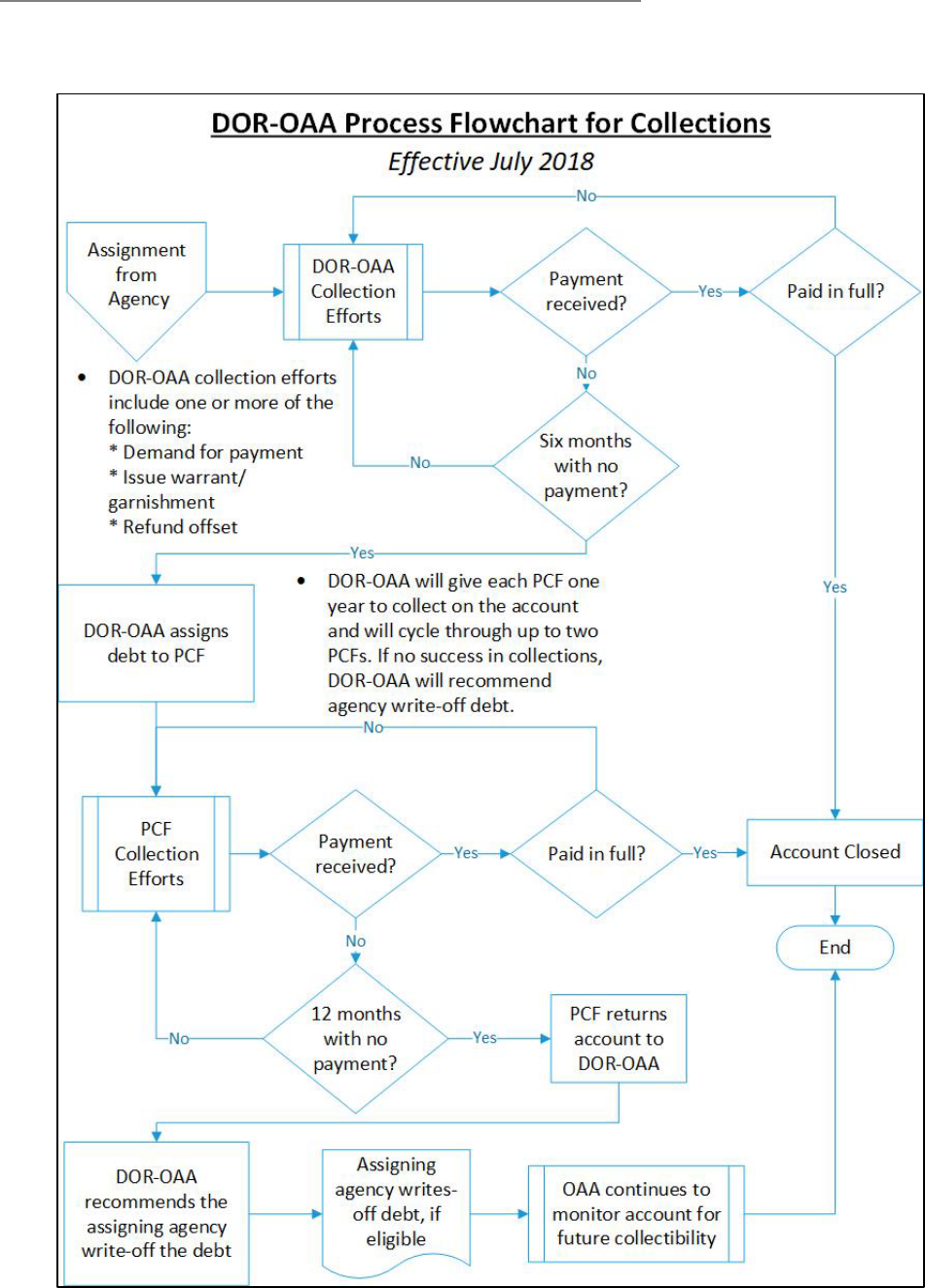

If state agencies internal collection processes are unsuccessful in recovery, ORS 293.231(1)

requires the state agency to use external sources to assist with ongoing efforts to collect the

debt (Fig. 5). Once an account has met the definition of being liquidated & delinquent,

18

ORS 1.194-1.202 documents the collection of court account requirements; including, but not limited to, account assignment provisions.

19

ORS 293.231 documents the account assignment requirements for Administrative or Executive Branch agencies subject to ORS Chapter

293, however, not all Executive Branch agencies are subject to ORS 293.231.

20

OAM 01.05.00 documents the scope and applicability of the OAM.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

19

Executive Branch agencies must assign it to DOR-OAA not later than 90 days from the date the

account was liquidated (if no payment was received on the account within the 90-day period)

or 90 days from the date of receipt of the most recent payment on the account.

Not all L&D accounts are subject to the assignment provisions outlined above; ORS 293.231(7)

and OAM 35.40.10 provide exemptions that may be applied at the discretion of the agency.

Examples of assignment exemptions include, but are not limited to, accounts that are: secured

by a consensual security interest; valued at less than $100 including penalties; owed by an

estate in which the agency received notice the estate is closed; or owed by a debtor

hospitalized in a state hospital.

Since July 1, 2018, L&D accounts assigned to DOR-OAA (per ORS 293.231(3)) remain in full

collection status for six months from the date of assignment or from the date of the last

payment applied to the account. Per statute, if DOR-OAA does not collect a payment within

that six-month period, DOR-OAA forwards the account to a PCF for additional collection

services. If no payment is received within 12 months, the PCF is required to return the account

to DOR-OAA, who forwards the account to a different PCF. If the second PCF is not successful

with collections, DOR-OAA will recommend to the agency that the account be written-off.

Once DOR-OAA recommends an account for write-off, the agency evaluates the account to

determine if the account is uncollectible and eligible for write-off as per the Attorney General-

approved criteria documented in OAM 35.50.10. When the agency determines the account

should be written-off, the debt is removed from the agency’s accounting records. However,

because the liability of the debt continues after the account has been written-off, the account

is maintained with DOR-OAA for possible future collection including, but not limited to, offset

of tax refunds or garnishment of wages if the “New Hire” report

21

indicates that a debtor

secures employment.

The external collections process is one that involves many steps and can take multiple years

before resulting in a collection or and uncollectible determination.

21

ORS 25.793 Authorizes the Division of Child Support of the Department of Justice to enter into agreements with the Department of Revenue

for the provision of information reported by an employer.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

20

Figure 4.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

21

Figure 5.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

22

JUDICIAL BRANCH AGENCIES

Per ORS 1.197(1), agencies within the Judicial Branch of state government shall offer to

assign L&D accounts not later than one year from the date the account was liquidated (if no

payment was received on the account within that year) or one year from the date of receipt of

the most recent payment on the account.

Furthermore, per ORS 1.197(5), DOR-OAA has one year to collect on L&D accounts assigned by

agencies of the Judicial Branch. If DOR-OAA is not successful in their collection activities

within one year, or if one year has lapsed since the date of receipt of the most recent payment

on the account, DOR-OAA must notify and return the account to the respective Judicial Branch

agency who must then immediately offer to assign the account to a PCF. The Judicial Branch

maintains an agreement with multiple vendors.

Some Judicial Branch L&D accounts may be exempt from the one-year assignment provisions

referenced above. As provided in ORS 1.199(1), the State Court Administrator may establish

policies and procedures for exempting accounts in addition to the exemptions referenced in

ORS 1.198. Agencies of the Judicial Branch of state government are not subject to the

statewide policies and procedures referenced in the OAM.

COLLECTION ISSUES AND CHALLENGES

State agencies face several challenges impacting collection processes. In an effort to better

understand these challenges, and to identify solutions for overcoming these challenges, one

must analyze the type of challenges that exist: data availability; systems; standardization; and

resources.

DATA AVAILABILITY

An integral component to achieving successful collections of L&D debt is the availability of

accurate, complete, and current data, however, the availability of the desired data varies

depending upon the nature of the debt and the debtor. For example: when a civil penalty has

been issued to an individual for unlicensed practice, the individual may be operating under an

alias or false identity, which, in turn impacts the ability of the agency to successfully collect the

debt.

State agencies that provide goods or services are encouraged to obtain customer data prior to

providing the goods or services in the event the account becomes L&D. Since the process

associated with obtaining additional data may create added resource burdens, state agencies

must evaluate the cost associated with collecting more data on the front end compared to the

likelihood of collection activity. State agencies that accept checks as a form of payment also

accept the risk that the check may be returned for non-sufficient funds. In these cases, the

Fiscal Year 2023 Statewide Accounts Receivable Management Report

23

state agency may only have data available from the face of the check, which could be stolen,

fraudulent, or outdated.

SYSTEMS

Much like data integrity, the systems on which accounts are tracked are also an integral

component in the successful collection of L&D debt. The majority of state agencies use a

Microsoft Excel spreadsheet to track and report accounts receivable while the remaining

agencies use legacy mainframe or third-party software applications. Due to the complex

nature of collection activities, an Excel spreadsheet is not an ideal mechanism for effectively

and efficiently managing accounts receivable transactions.

Even robust systems, such as the Statewide Financial Management Application (SFMA), have

limitations, which require state agencies to maintain subsidiary systems to track the details

associated with L&D accounts. For example, to comply with the statutory assignment

provisions, agencies must track the date an account became delinquent as well as the date the

account became liquidated. While state agencies may use an aging report generated with data

entered in SFMA to establish account delinquency; the data necessary to determine the date of

liquidation is not available in SFMA. As a result, agency accounts receivable professionals

must track these data points separately.

GenTax, the system purchased by DOR for tax administration, has many benefits to assist DOR

with collecting tax and non-tax debts; however, since the system’s primary function is tax

administration, the collection functionality needed for DOR-OAA to provide information to

client agencies is limited. Though GenTax includes improved collection functionality not

previously available, the reporting limitations create challenges for DOR-OAA client agencies

by requiring them to rely upon other, more manual processes to effectively manage and

reconcile accounts assigned for collections to DOR-OAA. As the state considers options to

further enhance debt collections, investments may be necessary to either augment GenTax or

acquire a portfolio management system.

STANDARDIZATION

Standardizing processes is a challenge that some state agencies face when collecting L&D

debt. Though agencies have the authority to establish internal processes to ensure compliance

with applicable federal and state requirements, the diverse nature of business units may

challenge the agency’s ability to create standardized processes within the agency. Diverse

business units result in diverse types of debt with varying levels of requirements resulting in

unique processes for each business unit or type of debt. This challenge makes it difficult for

state agencies to efficiently standardize collection processes; an important factor when

limited resources are available to conduct effective and efficient collection activities. Even

though state agencies may have similar regulatory functions and authorities such as civil

Fiscal Year 2023 Statewide Accounts Receivable Management Report

24

penalties, the diversity of issues within each agency may require varying methods when

implementing those same authorities.

RESOURCES

Resource challenges affect not only the availability of staff dedicated to the management and

collection of debt but also the training and expertise of the available staff. Often, collection

work in state agencies is completed by accountants responsible for accounts receivable

billing. Though this may seem like a natural fit, collection work and accounting work are quite

different functions and require different skillsets. In addition, the primary purpose of an

accounts receivable accountant is to accurately and timely bill for goods or services when

provided and to record the applicable accounting entries in the general ledger. A debt collector

requires a unique set of skills that include: investigation skills to locate debtors and collectible

assets; negotiation skills; and enforcement capabilities, such as garnishment and lien

recording. The skills required for debt collection are not commonly listed in job requirements

for accounting positions. Many state agencies report that their priority is to bill for goods or

services when provided while collection activities are often conducted as time allows and as

staff are available.

When an agency determines the percentage of accounts that become L&D are immaterial

compared to the percentage of accounts that are paid timely, it is not surprising that agencies

prioritize their work accordingly.

In addition, when only a portion of an employee’s position is allocated to infrequently

performing debt collection tasks, the challenge includes maintaining up-to-date collection

techniques in addition to the availability of dedicated staff.

Collection staff need to be well-versed in applicable federal and state regulations to ensure

due process has been afforded the debtor and that appropriate notifications are made prior to

escalating collection efforts. Appropriate notifications include potential consequences for

failing to pay, such as: penalties; interest; garnishment; assignment of the account to

collections and associated collection costs. Due process also provides many opportunities for

the debtor to dispute or appeal the debt. Failure to provide proper notification to the debtor

could result in the agency being legally liable for damages or penalties.

STATEWIDE ACCOUNTS RECEIVABLE MANAGEMENT

ORS 293.252 requires DAS to monitor state agency debt collection functions and assist state

agencies in efforts to improve the collection of delinquent debts owed to state agencies. To

meet the statutory requirements, DAS created the SWARM team to provide training on

processing and managing accounts receivable; offer technical assistance in resolving

accounts receivable challenges; develop performance standards for state debt collection and

Fiscal Year 2023 Statewide Accounts Receivable Management Report

25

work with state agencies to improve the quality of data submitted to LFO. To improve the

collection of delinquent debts and foster improved agency collaboration, SWARM developed

the Accounts Receivable Core Committee (ARCC).

ACCOUNTS RECEIVABLE CORE COMMITTEE

Comprised of accounts receivable representatives from a variety of state agencies, ARCC

meets every other month to discuss current collection practices and assist SWARM in

developing strategies to improve statewide accounts receivable management. ARCC also

serves as a forum for state agency accounts receivable professionals to collaborate with

peers from other state agencies and to discuss successful collection strategies, lessons

learned, and best practices. The work of the ARCC is a valuable part of improving statewide

debt collections and overall accounts receivable management practices through the

collaboration, partnership, and forward-thinking of accounts receivable professionals.

FACTORS IN COLLECTING ACCOUNTS RECEIVABLES

Key factors which influence the collectability of an accounts receivable are: (i) the type of

accounts receivable; (ii) types of debtors; and (iii) the debtor’s ability and willingness to pay.

TYPES OF ACCOUNTS RECEIVABLES

State agency accounts receivable include a diverse representation of legally enforceable

claims for payment ranging from benefit overpayments to court-ordered restitution (Table 8).

Table 8.

Types of State Agency Accounts Receivable

22

Administrative hearing orders

Loans

Benefit overpayments (unemployment or

public assistance)

Medical services

Contract or service level agreements

Restitution

Court orders (civil or criminal judgment)

Support orders (child or spousal)

Employee overpayments (current or former

employee)

Taxes

Fees, fines and penalties

Tuition

Licensing (application or renewal)

22

The list in Table 8 represents the most common types of state agency accounts receivable; as such, this list is not all-inclusive.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

26

Certain types of accounts receivable are easier to collect than others. For example, when a

licensing agency can suspend or revoke a license if the debt is not paid, the debtor is more

likely to voluntarily pay to avoid a suspension.

In FY 2023, 92% of the Executive Branch outstanding balances of L&D accounts are owed to

the following four agencies.

Department of Revenue

Debt balances reported by DOR include taxes, fees, penalties and interest owed to the state by

individuals and businesses. The debts are primarily payable to the General Fund. Most of the

debt balances reported by DOR are related to personal income taxes. Accounts collected by

DOR-OAA are not included in this amount since they are reported by the agency that assigned

the account.

Department of Justice

DOJ’s debt balances are comprised primarily of: child support recoveries which are remitted to

the custodial parent when collected; punitive damages awarded to the Crime Victims Services

Division; and court judgments from the Financial Fraud, Consumer Protection and Charities

programs. The debts are largely payable to Federal Funds and Other Funds.

Oregon Employment Department

Debt balances reported by OED include unemployment insurance (UI) benefit overpayments

and delinquent UI employer-paid taxes. UI benefit overpayments result from administrative

decisions that determine a claimant was not eligible to receive benefits. UI benefit

overpayments arise from claimant error, non-claimant error, or fraud. Both types of UI debts

include amounts that have accumulated over many years and may have been subject to

additional penalties and interest. The debts are payable to Other Funds.

Department of Consumer and Business Services

DCBS’s debt balances result from a variety of programs ranging from workers compensation

and occupational safety to financial regulation and building codes. Outstanding balances are

fines or penalties related to regulatory enforcement and are primarily payable to Other Funds.

TYPES OF DEBTORS

State agency debtors’ range across the diverse socio-economic spectrum and can be either

individuals, businesses, or organizations depending on the type of the debt (Table 9). State

agencies often do not get to choose their customers or deny services based on ability to pay;

therefore, a reactive approach to accounts receivable management is common.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

27

Table 9.

Type of State Agency Debtors

Corporations, partnerships, LLCs, etc. Licensed professionals

Employed individuals Not-for-profit organizations

Incarcerated individuals Out-of-state individuals

Individuals in the care of a state hospital Students

Individuals on state assistance Unemployed individuals

Individuals on state medical assistance Unlicensed individuals or businesses

Individuals with limited income Veterans

THE DEBTOR’S ABILITY AND WILLINGNESS TO PAY

Collectability of a debt expands beyond the type of debtor and includes evaluation of the

debtor’s ability and willingness to pay. A common matrix used by a PCF determines if the

debtor is: able and willing to pay; able to pay but unwilling; unable to pay but willing; or unable

and unwilling to pay (Fig. 6). Evaluating the probability of collection is valuable for determining

the most cost effective and efficient method of pursuing the debt.

It is important to remember that over time a debtor’s ability to pay may be subject to changes

in their socio-economic status, while their willingness to pay typically does not change.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

28

Figure 6.

For those debtors who are willing and unable to pay due to low-income or loss of employment,

enforced collection of the debt through garnishment may prove difficult and could exacerbate

their circumstances and create an unintentional hardship. In these situations, state agencies

or PCF representatives may enter into repayment agreements that span longer periods of time.

When a debtor is willing to pay but unable, monitoring the account and the debtor’s socio-

economic status becomes pivotal since their ability to pay may change over time.

Alternatively, debtors who are unwilling to pay despite their ability, create more of a challenge

to debt collectors because, as noted above, the debtor’s willingness to pay typically does not

change over time. In these instances, more aggressive collection techniques should be

exercised, such as issuing garnishments or placing a non-consensual lien against the debtor’s

real property. However, these collection tools are only effective when the debtor has assets.

Each factor referenced above impacts the ability of state agencies to effectively collect debts.

By evaluating the nature of the debt, socio-economic status of the debtor, and the debtor’s

ability and willingness to pay, debt collectors are able to maximize collection efforts by

prioritizing and allocating collection resources to maximize efficiency and recovery.

Notwithstanding these factors, state agency representatives may also align collection

techniques with the mission of the agency. For example, an individual who receives public

assistance may become a debtor due to a benefit overpayment. Aggressive attempts to

recover the overpayment while the debtor is still facing economic challenges may be contrary

to the mission of the agency to provide public assistance.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

29

COLLECTION TOOLS

State agencies have several tools available for use in collecting debts (Table 10). Some tools

are limited for use by agencies with unique statutory authority while other tools are available

for use by all state agencies regardless of the nature of the accounts receivable.

Table 10.

Collection Tools

23

Collection letter, demand notice Non-consensual real property lien

DOR-OAA (full service collections) PCF (full service collections)

DOR-Refund Offset (restricted collections) Phone calls

Garnishment Skip-tracing

Judgment Unclaimed property claim

State agencies are responsible for performing preliminary collection activities which include:

contacting the debtor by phone; sending collection letters or demand notices; and updating

debtor contact information. When the debt becomes L&D, state agencies subject to the

statutory assignment provisions under ORS 293.231 must assign the account to DOR-OAA.

Once accounts are assigned to DOR-OAA, full service collection activities commence.

Full service collection activities include the preliminary collection activities referenced

previously, as well as: locating a debtor or debtor assets; offsetting state tax refunds;

submitting a claim with the Department of State Lands against a debtor’s unclaimed property;

and issuing garnishments. State agencies with internal collection units perform full service

collection activities prior to assigning an L&D account to DOR-OAA.

Many licensing and regulatory agencies have statutory authority to issue civil penalties against

individuals or businesses that operate without a license or violate a statutory or administrative

regulation. These agencies have additional tools available to collect debts. More specifically,

upon issuance of a final civil penalty order, the agency may record the order in a county lien

23

The federal Treasury Offset Program and lottery offset tools have been excluded from table 10 since they are available to a limited number

of state agencies per federal or state law.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

30

register thus enabling the agency to issue garnishments or record a lien against real property

owned by the debtor.

DOR, OED, OHA, ODOT, DCBS, and ODHS have distraint warrant authority that, similar to civil

penalty authority, allows the agency to docket the warrant in a county lien register thus

enabling the agency to issue garnishments or record a lien against real property owned by the

debtor. Though a limited number of state agencies have distraint warrant authority, some L&D

accounts assigned to DOR-OAA qualify for a distraint warrant to be issued using DOR-OAA’s

statutory authority.

24

Any distraint warrants issued under DOR-OAA’s statutory authority will

remain in place if or when DOR-OAA assigns the debt to a PCF. However, if the originating

agency recalls the debt, the distraint warrant will be canceled by DOR-OAA.

Federal Treasury Offset Programs

25

Five state agencies have authority granted by the federal government to participate in the

Treasury Offset Programs (TOP), programs which intercepts federal payments to offset state

delinquent tax debts, public assistance debts, and unemployment insurance debts. In Oregon,

access to the TOP program is limited for use by ODHS, DOJ, DOR, OED, and OHA.

State Income Tax Program (SIT) - TOP offsets federal tax refund payments to payees who owe

delinquent state income tax obligations and state tax refunds may be used to offset federal

tax debts.

State Reciprocal Program (SRP)

26

- TOP offsets federal vendor and other non-tax payments to

payees who owe delinquent debts to state agencies. In return, states offset payments to

payees who owe delinquent debts to federal agencies.

Unemployment Insurance (UI) - In partnership with the US Department of Labor, TOP offsets

federal tax refund payments to: 1) payees who owe delinquent unemployment insurance

compensation debts due to fraud or a person’s failure to report earnings; and, 2) payees who

owe UI employer tax debts.

24

Liquidated and delinquent accounts may qualify for DOR-OAA to issue a distraint warrant if the debt meets one of the following conditions:

1) judgment was entered on the debt; 2) the debt is a tax debt for which a distraint warrant was issued or the prerequisites of issuance were

met; 3) liability for, and the amount of, the debt was established through an administrative proceeding; or 4) the debt is a non-complying

employer’s debt for claim and administrative costs eligible for referral under criteria identified by the Department of Justice (OAM 35.30.30

).

25

Bureau of the Fiscal Service; US Department of the Treasury. (August 2019). “SRP: New Ways to Increase Your State’s Collections”

PowerPoint presentation; NASACT Annual Conference.

26

US Office of Personnel Management retirement payments is now being offered for matching against SRP, SIT and UI debts, when the state

reciprocates their state retirement payments. Oregon is not participating in this program currently.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

31

Child Support Program (CS) - States submit delinquent child support obligations to the Office of

Child Support Enforcement, which in turn submits the debts to TOP for collection through the

offset of federal tax refund and other eligible payments.

Supplemental Nutritional Assistance Program (SNAP) - The Department of Agriculture, Food and

Nutrition Service (FNS), in collaboration with state offices administering the Food Stamp

Program, submit food stamp recipient debts to Treasury for offset of federal tax refund and

other eligible payments.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

32

APPENDIX B – LFO DATA BY BRANCH OF GOVERNMENT

State agency data reported by LFO is not separated by branch of government. Since this

management report focuses on liquidated and delinquent account activity reported by

Executive Branch agencies, the LFO data was separated by branch of government to provide a

reconciliation between data referenced in the LFO report and data referenced in this report.

Agencies within the Legislative Branch as well as special government entities are listed as “All

Others” (Table 11).

Table 11.

Total Liquidated and Delinquent Accounts Receivable

For the Year Ended June 30, 2023

Judicial

Executive

All Others

Total

Beginning Balance

$ 1,567,230,771

$ 1,640,843,057

$ 118,271,510

$ 3,326,345,338

Additions

131,397,857

928,161,476

55,454,648

1,115,013,981

Collections

(51,102,978)

(377,486,089)

(27,112,035)

(455,701,102)

Write-Offs

(19,007,812)

(36,652,805)

(12,649,398)

(68,310,015)

Adjustments

(109,329,826)

(235,259,519)

(7,296,060)

(351,885,405)

Reversals

-

(70,654,271)

(366,670)

(71,020,941)

Ending Balance

$1,519,188,012

$1,848,951,849

$ 126,301,995

$ 3,494,441,856

Doubtful Accounts

(1,265,939,371)

(531,967,272)

(40,719,189)

(1,838,625,832)

Adj. Ending Bal.

$ 253,248,641

$1,316,984,577

$ 85,582,806

$ 1,655,816,024

Assigned to the Department of Revenue - Other Agency Accounts

Beginning Balance

$ 467,856,308

$ 149,910,638

$ 26,147,365

$ 643,914,311

Additions

69,291,152

92,455,048

12,763,781

174,509,981

Collections

(26,063,559)

(8,709,665)

(5,956,887)

(40,730,111)

Return to Agency

(210,802,046)

(38,997,334)

(8,346,932)

(258,146,312)

Ending Balance

$ 300,281,855

$ 194,658,687

$ 24,607,327

$ 519,547,869

Fiscal Year 2023 Statewide Accounts Receivable Management Report

33

Assigned to Private Collection Firms

Beginning Balance

$ 480,361,062

$ 207,691,722

$ 50,361,213

$ 738,413,997

Additions

70,636,890

160,470,041

14,233,592

245,340,523

Collections

(4,544,994)

(11,891,877)

(1,207,820)

(17,644,691)

Return to Agency

(352,478,762)

(119,683,679)

(9,693,318)

(481,855,759)

Ending Balance

$ 193,974,196

$ 236,586,207

$ 53,693,667

$ 484,254,070

Accounts Exempt from Assignment

Administrative

$ 35,326,140

$ 770,323,969

$ -

$ 805,650,109

Statutory

273,583,638

237,856,977

1,813,803

513,254,418

Total Exemptions

$ 308,909,778

$1,008,180,946

$ 1,813,803

$ 1,318,904,527

Fiscal Year 2023 Statewide Accounts Receivable Management Report

34

APPENDIX C – GLOSSARY OF TERMS

Additions – The number and value of accounts that became liquidated and delinquent (L&D)

on or after July 1 of the reporting fiscal year.

Adjustments – Entries to increase or decrease a portion of the debt. Adjustments may be the

result of an administrative error or when the debt is legally determined not to be owed (as in

bankruptcy or an offer in compromise). Adjustments never result from write-offs.

Collections – (1) All payments received by an agency as payment towards billings or accounts

receivable, including amounts received from collection agencies. (2) The process or activity of

collecting on a debt either by the agency or a third party.

Delinquent (OAM 35.30.30) – An accounts receivable for which payment has not been

received by the due date.

Garnishment – Legal proceeding that authorizes a third party to directly attach the debtor's

funds, such as wages or a bank deposit, to satisfy a creditor's claim.

Judgment – A court order ruling the debtor is indebted to and must make payments to the

creditor of a specific amount.

Lien – A claim (which can include a judgment) or charge upon real or personal property for the

satisfaction of some debt.

Liquidated (OAM 35.30.30) – An amount owing to a state agency that meets all of the

following criteria:

1) an agency has determined an exact past due amount owing; and

2) an agency has made a reasonable attempt to notify the debtor in writing of the amount

owing, the nature of the debt, and has requested payment; and

3) the debt meets one of the following conditions:

a) A judgment has been entered.

b) Is a tax debt for which a distraint warrant has been issued or the prerequisites of

issuance have been met.

c) Liability for and the amount have been established through an administrative

proceeding.

d) Arises from a promissory note.

e) Is due to a pre-existing agreement between the state agency and the debtor; an

invoice or a statement of account has been mailed or delivered to the debtor; and

the debtor has not objected within a reasonable time.

Fiscal Year 2023 Statewide Accounts Receivable Management Report

35

f) The debtor has acknowledged the debt in writing (both as to liability and amount)

or a written agreement has been reached between the state agency and the

debtor regarding the debt (both liability and amount).