T HE STRATEGY AND

TACTICS OF PRICING

The Strategy and Tactics of Pricing explains how to manage markets strategically and

how to grow more profi tably. Rather than calculating prices to cover costs or achieve

sales goals, students will learn to make strategic pricing decisions that proactively man-

age customer perceptions of value, motivate purchasing decisions, and shift demand

curves.

This edition features a new discussion on harnessing concepts from behavioral

economics as well as a more streamlined “value cascade” structure to the topics. Read-

ers will also benefi t from:

• Major revisions to almost half of the chapters, including an expanded discussion

of big data analytics and a revised chapter on “Specialized Strategies”, which

addresses timely technical issues like foreign exchange risks, reactions to market

slumps, and managing transfer prices between independent profi t centers.

• A completely rewritten chapter on “Creating a Strategic Pricing Capability”,

which shows readers how to implement the principles of value-based, strategic

pricing successfully in their organizations.

• In-chapter textboxes, updated to provide walk-through examples of current pric-

ing challenges, revenue models enabled by an increasingly digital economy, and

advances in buyer decision-making, explained through classic principles that

still apply today.

• Chapter summaries and visual aids, which help readers grasp the theoretical

frameworks and actionable principles of pricing analysis.

This comprehensive, managerially-focused text is a must-read for students and pro-

fessionals with an interest in strategic marketing and pricing. A companion website

features PowerPoint slides with instructor notes, discussion questions, and exercises,

as well as suggested readings and cases with separate teaching notes for instructors.

Thomas T. Nagle , Ph.D., is a Senior Advisor in the Pricing and Profi tability Manage-

ment practice at Deloitte Consulting, USA. For over 30 years, he has developed many

of the most popular analytical tools and conceptual frameworks for strategic pricing

and profi t improvement.

Georg Müller, Ph.D., is a Managing Director in the Pricing and Profi tability Manage-

ment practice at Deloitte Consulting, USA. He focuses on driving top-line margin

improvement through strategic pricing for companies representing multiple sectors.

He also leads executive development on strategic pricing at the University of Chicago,

Booth School of Business, USA.

“The principles of business profi tability stressed in The Strategy and Tactics of

Pricing make it an absolute must-read for all business professionals who care

about creating value and profi tability for their organization. I have person-

ally practiced the knowledge gained from The Strategy and Tactics of Pricing,

operating in hyper-competitive business environments, with great success.”

—Lynn Guinn, Global Strategic Pricing Leader at Cargill, USA

“For over three decades, this book has been the most infl uential and highly

regarded reference for pricing professionals. New sections on today’s most

pressing business topics make it an indispensable tool to improve your com-

pany’s performance.”

—Kevin Mitchell, President of The Professional Pricing Society, Inc., USA

“The best pricing book on the planet! The go-to resource for pricing

success—powerful, practical, and profi table!”

—Mark Bergen, James D. Watkins Chair in Marketing, Carlson

School of Management, University of Minnesota, USA

Sixth Edition

T HE STRATEGY AND

TACTICS OF PRICING

A GUIDE TO GROWING

MORE PROFITABLY

Thomas T. Nagle

Georg Müller

Sixth edition published 2018

by Routledge

711 Third Avenue, New York, NY 10017

and by Routledge

2 Park Square, Milton Park, Abingdon, Oxon, OX14 4RN

Routledge is an imprint of the Taylor & Francis Group, an informa business

© 2018 Taylor & Francis

The right of Thomas T. Nagle and Georg Müller to be identifi ed as authors of

this work has been asserted by them in accordance with sections 77 and 78 of the

Copyright, Designs and Patents Act 1988.

All rights reserved. No part of this book may be reprinted or reproduced or utilised

in any form or by any electronic, mechanical, or other means, now known or hereafter

invented, including photocopying and recording, or in any information storage or

retrieval system, without permission in writing from the publishers.

Trademark notice : Product or corporate names may be trademarks or registered

trademarks, and are used only for identifi cation and explanation without intent

to infringe.

First edition published by Prentice Hall 1987

Fifth edition published by Routledge 2016

Library of Congress Cataloging-in-Publication Data

A catalog record for this book has been requested

ISBN: 978-1-138-73750-1 (hbk)

ISBN: 978-1-138-73751-8 (pbk)

ISBN: 978-1-315-18530-9 (ebk)

Typeset in Palatino

by Apex CoVantage, LLC

Visit the companion website: www.routledge.com/cw/nagle

Preface xiii

Acknowledgments xv

List of In-Line Boxes xvii

List of Exhibits xix

Chapter 1 Strategic Pricing 1

Coordinating the Drivers of Profi tability

Chapter 2 Economic Value 26

The Guiding Force of Pricing Strategy

Chapter 3 Price and Value Communication 56

Strategies to Infl uence Willingness-to-Pay

Chapter 4 Price Structure 76

Tactics for Pricing Differently Across Customer Segments

Chapter 5 Pricing Policy 106

Infl uencing Customer Expectations and Purchase Behaviors

Chapter 6 Price Level 133

Setting Prices that Capture a Share of the Value Created

Chapter 7 Price Competition 152

Managing Confl ict Thoughtfully

Chapter 8 Measurement of Price Sensitivity 173

Research Techniques to Supplement Judgment

Chapter 9 Financial Analysis 207

Analyzing Costs and Profi ts for Pricing

Chapter 10 Specialized Strategies 240

Adapting Pricing to Accommodate Common Challenges

Chapter 11 Creating Strategic Pricing Capability 262

Assembling Talent, Processes, and Data to Build

Competitive Advantage

Chapter 12 Ethics and the Law 293

Understanding the Constraints on Pricing

Index 317

CONTENTS

DETAILED TABLE OF CONTENTS

Chapter 1 Strategic Pricing 1

Coordinating the Drivers of Profi tability

Leveraging Profi t into Sustainable Growth 2

Cost-Plus Pricing 4

Customer-Driven Pricing 5

Share-Driven Pricing 6

The Role of “Optimizing” in Strategic Pricing 7

What Is Strategic Pricing? 9

Value Creation 12

Value Communication 15

Price Structure 17

Pricing Policy 18

Price Setting 19

Price Competition 20

Creating a Strategic Pricing Capability 21

Summary 23 • Notes 23

Chapter 2 Economic Value 26

The Guiding Force of Pricing Strategy

The Role of Value in Pricing 27

How to Estimate Economic Value 30

Competitive Reference Prices 31

Estimating Monetary Value 33

Monetary Value Estimation: An Illustration 36

Estimating Psychological Value 41

Psychological Value Estimation: An Illustration 42

The High Cost of Shortcuts 45

Value-Based Market Segmentation 47

Step 1: Determine Basic Segmentation Criteria 49

Step 2: Identify Discriminating Value Drivers 50

Step 3: Determine Your Operational Constraints

and Advantages 50

Step 4: Create Primary and Secondary Segments 50

Step 5: Create Detailed Segment Descriptions 53

Step 6: Develop Segment Metrics and Fences 53

Summary 54 • Notes 54

Detailed Table of Contentsviii

Chapter 3 Price and Value Communication 56

Strategies to Infl uence Willingness-to-Pay

Value Communication 58

Adapting the Message for Product Characteristics 58

Low-Involvement, Psychological Benefi ts 60

Low-Involvement, Economic Benefi ts 60

High Involvement, Psychological Benefi ts 61

High Involvement, Economic Benefi ts 61

Strategies for Conveying Value 62

Competitive-Reference Effect 65

Switching-Cost Effect 66

Diffi cult-Comparison Effect 66

End-Benefi t Effect 67

Price-Quality Effect 68

Expenditure Effect 70

Shared-Cost Effect 70

Transaction Value Effect 71

Fairness Effect 72

Multiple Participants in the Buying Process 73

Summary 74 • Notes 75

Chapter 4 Price Structure 76

Tactics for Pricing Differently Across

Customer Segments

Challenges That Can Undermine Segmented

Pricing 79

Offer Confi gurations 80

Optimizing the Structure of Offer Bundles 81

Designing Segment-Specifi c Bundles 83

Unbundling Strategically 84

Price Metrics 85

Creating Good Price Metrics 86

Performance-Based Metrics 89

Tie-Ins as Metrics 92

Price Fences 95

Buyer Identifi cation Fences 95

Purchase Location Fences 97

Time-of-Purchase Fences 98

Purchase Quantity Fences 99

Peak Pricing and Yield Management 101

Summary 104 • Notes 104

Detailed Table of Contents ix

Chapter 5 Pricing Policy 106

Infl uencing Customer Expectations and Purchase

Behaviors

Pricing Policies and Price Expectations 107

The Emergence of Strategic Sourcing 108

Policies for Price Negotiation 110

Policies for Responding to Price Objections 114

The Problem with Reactive, Ad Hoc Price

Negotiation 114

The Benefi ts of Proactive, Policy-Based Price

Negotiation 116

Policies for Different Buyer Types 118

Policies for Dealing with Power Buyers 123

Policies for Successfully Managing Price Increases 125

Policies for Leading an Industry-Wide Increase 126

Policies for Transitioning from Flexible to

Policy-Based Pricing 127

Policies for Pricing in an Economic Downturn 128

Policies for Promotional Pricing 130

Summary 131 • Notes 131

Chapter 6 Price Level 133

Setting Prices that Capture a Share

of the Value Created

The Price-Setting Process 134

Step 1: Defi ne the Viable Price Range 135

Step 2: Make Strategic Choices 137

Step 3: Assess Breakeven Sales Changes 142

Step 4: Gauge Price Elasticity 145

Step 5: Account for Psychological Factors 147

Communicating New Prices to the Market 149

Summary 151 • Notes 151

Chapter 7 Price Competition 152

Managing Confl ict Thoughtfully

Understanding the Pricing Game 153

Competing to Grow Profi tably 154

Reacting to Competition: Think Before You Act 159

Managing Competitive Information 165

Collect and Evaluate Competitive Information 166

Selectively Communicate Information 168

When Should You Compete on Price? 170

Summary 171 • Notes 172

Detailed Table of Contentsx

Chapter 8 Measurement of Price Sensitivity 173

Research Techniques to Supplement Judgment

Types of Measurement Procedures 174

Uncontrolled Studies of Actual Purchases 175

Historical Sales Data 175

Panel Data 176

Store-Level Transaction Data 178

Analyzing Historical Data 179

Experimentally Controlled Studies of Actual

Purchases 181

In-Store Purchase Experiments 181

Laboratory Purchase Experiments 182

Uncontrolled Studies of Preferences and Intentions 185

Direct Questioning 186

Buy-Response Surveys 186

Attribute Rating 186

In-Depth Interviews 189

Experimentally Controlled Studies of Preferences and

Intentions 191

Simulated Purchase Experiments 191

Trade-Off (Conjoint) Analysis 192

Using Measurement Techniques Appropriately 197

Using Judgment for Better Measurement 198

Using Online and Mobile Techniques 200

Outside Sources of Data 200

Selecting the Appropriate Measurement Technique 201

Summary 202 • Notes 204

Chapter 9 Financial Analysis 207

Analyzing Costs and Profi ts for Pricing

Evaluating the Financial Implications of Price

Alternatives 207

Why Incremental Costs? 208

Why Focus on Avoidable Costs? 212

Understanding the Financial Implications of Alternative

Price Levels 213

Evaluating the Potential Profi tability of a Price

Change 214

Breakeven Sales Incorporating a Change in Variable

Costs 218

Breakeven Sales Analysis for Reactive Pricing 219

Mapping a Range of Potential Financial Outcomes 221

Breakeven Sales Curves 223

Detailed Table of Contents xi

Watching Your Baseline 227

Covering Non-Incremental Fixed and Sunk Costs 228

Summary 229 • Notes 229

Appendix 9A 231

Case study

Appendix 9B 238

Derivation of the Breakeven Formula

Chapter 10 Specialized Strategies 240

Adapting Pricing to Accommodate Common

Challenges

Adapting Pricing Strategy over Category

Life Cycle 240

Pricing an Innovation 241

Price Reductions in Growth 244

Pricing the Established Product in Maturity 245

Managing Export Prices in Foreign Currencies 248

Foreign Market Sales Strategy 248

Competitive Impact of Exchange Rate Shifts 250

Four Generic Strategies for Managing Exchange

Rate Price Adjustments 250

Managing Pricing When Markets Slump 253

Creating Economically Effi cient Transfer Prices 255

Summary 259 • Notes 260

Chapter 11 Creating Strategic Pricing Capability 262

Assembling Talent, Processes, and Data to Build

Competitive Advantage

Essential Elements of the Pricing Organization 268

Creating Alignment on Pricing Objectives 270

Matching the Extent of Pricing Centralization with

Organizational Needs 271

Decision Rights Specify Pricing Roles and

Responsibilities 273

Pricing Processes to Ensure Successful Strategy

Implementation 274

Performance Measures and Incentives: Aligning

Sales Incentives with Strategy 276

Systems to Support the Pricing Function 279

Data Needed to Inform the Pricing Function 279

Common Protocols for Creating Relevant

Insights 279

Customer Analytics to Guide Management Choices 280

Analysis of Win–Loss Data 280

Detailed Table of Contentsxii

Customer Profi tability and Cost to Serve 281

Process Management Analytics 283

Price Bands 283

Price Waterfalls 284

Pricing Systems 286

Managing the Organizational Change Process 288

Senior Management Leadership 289

Demonstration Projects 289

Summary 290 • Notes 291

Chapter 12 Ethics and the Law 293

Understanding the Constraints on Pricing

Ethical Constraints on Pricing 293

The Legal Framework for Pricing 296

The Effect of Sarbanes–Oxley on Pricing Practices 297

Price Fixing or Price Encouragement 298

Horizontal Price Fixing 299

Resale Price Fixing or Encouragement 299

Vertical Price Fixing 299

Direct Dealing Programs 301

Resale Price Encouragement 301

Price and Promotional Discrimination 302

Price Discrimination 303

Defenses to Price Discrimination 304

Promotional Discrimination 305

Competitive Injury, Defenses, and Indirect

Purchasers 306

Using Non-Price Variables to Support Pricing Goals 306

Vertical Non-Price Restrictions 306

Non-Price Incentives 308

Other Pricing Issues 308

Predatory Pricing 308

Price Signaling 309

Summary 309 • Notes 310

PREFACE

Since the fi rst edition of this book over 30 years ago, our goal has been to rebut

the common misperception that pricing is an afterthought to a growth strategy:

a simple process of calculating the “right” price for a product or transaction.

Over those years, both marketing practitioners and academics have largely

come to recognize that a profi table pricing strategy requires proactively man-

aging much more than just price. It requires thoughtful and proactive manage-

ment of choices about what to offer, how information about price and value

is communicated, perceptions created in the process of price negotiation, and

choices about when, where, and how to compete for market share. Today lead-

ing organizations are leveraging the principles of strategic pricing described in

this book to actively infl uence willingness-to-pay. They are, in effect, shifting

demand curves as opposed to just reacting to them.

To infl uence demand and willingness-to-pay, profi table pricing requires

looking beneath simple concepts like demand and demand elasticity to under-

stand and manage the perceptions of monetary and psychological value that

motivate purchase decisions. Mastering the value proposition enables a fi rm

(i) to segment prices to refl ect differences in value and cost; (ii) to commu-

nicate the value of its offers to customers unfamiliar with the market; and

(iii) to create pricing policies for managing pricing issues fairly and consis-

tently. In short, this book shows managers how to move from tactically “opti-

mizing” prices in markets where they seemingly exercise little control to

managing the market strategically. When that happens, pricing becomes an

integral part of a strategy to grow profi tably , rather than just a blunt instrument

to drive sales and market share.

The principles of strategic pricing, which were foreign to most business

practitioners when the fi rst edition of this book was published more than three

decades ago, are now more widely accepted in principle. However, most com-

panies still struggle with their application. The changes in this sixth edition of

our book refl ect our attempts to address this need:

• To help our readers better conceptualize the range of interrelated tasks

involved in strategic pricing, we have organized this edition around a

“value cascade” that organizes those tasks into six distinct categories.

• The fi eld of behavioral economics has absolutely exploded since the fi rst

edition of this book and has gained more widespread acceptance; the

chapter on “Price and Value Communication: Strategies to Infl uence

Willingness-to-Pay” highlights several of the behavioral economic prin-

ciples that are particularly important to consider when proactively man-

aging prices and value perceptions.

• We have substantially revised the chapter on “Price Level: Setting the

Prices That Capture a Share of the Value Created” to present a robust

process for determining appropriate price levels. The chapter refl ects

the reality that companies in only a few markets (e.g., online retailing)

can map their demand, and its changes over time, with suffi cient accu-

racy to set the “best” price exactly. Our approach now describes how

Prefacexiv

to assemble data and process information to support a cross-functional

dialogue that arrives at “good” price decisions based upon thoughtfully

weighing the information at hand.

• The chapter on “Price Competition: Managing Confl ict Thoughtfully”

provides an in-depth understanding of value-destroying price wars,

how to mitigate the damage of a price war, and perhaps most impor-

tant, how to minimize the chances of provoking destructive responses to

one’s own pricing decisions.

• The chapter on “Specialized Strategies: Adapting Pricing to Accommo-

date Common Challenges” has been added to address some of the more

technical issues that managers might encounter such as managing pric-

ing over a product lifecycle, addressing foreign exchange risks, how to

act when a market slumps, and managing transfer prices between inde-

pendent profi t centers.

• A completely rewritten chapter on “Creating a Strategic Pricing Capabil-

ity” describes the process for transforming an organization to one that

embeds the principles of value-based strategic pricing into the processes

and incentives of the organization.

• Throughout this edition, we have updated examples to illustrate more

current pricing challenges, new revenue models enabled by our increas-

ingly digital economy, and advances in the study of buyer decision

making. At the same time, we have also retained a number of “classic”

examples that contain lessons that remain highly relevant and applicable

today.

As with prior editions, the primary objective of this book is to develop a practi-

cal and readable manager’s guide to pricing. Professors will be happy to learn

that we have updated the Instructor’s Manual for this edition to include new

exercises, mini-cases, and examination questions. We also provide a link to

Deloitte’s Polaris analytical pricing software to allow students to put theory

into practice by exploring real-world scenarios.

ACKNOWLEDGMENTS

Over the years the book has benefi ted from the infl uence and efforts of indi-

viduals too numerous to mention here. Nevertheless, we would be remiss

not to acknowledge a few whose contributions have either been very large or

new to this edition. Professor Gerald Smith’s contributions to the prior edi-

tions of this book and the instructor’s manuals are still refl ected in the current

ones. Professor Mark Bergen was an invaluable sounding board and source

of inspiration in developing portions of this book. Michael Goldberg was a

diligent researcher, copy editor, and administrator, without whose persistent

prodding this edition would still be “in process.” Junaid Qureshi drew on his

expertise of the gaming industry to develop a very compelling overview of

the evolution of pricing models for video games to augment the chapter on

“Price Structure: Tactics for Pricing Differently Across Customer Segments.”

Eugene Zelek, together with his colleague, Lauren Berheide, of Freeborn &

Peters once again shared his knowledge of pricing and the law to keep that

chapter current. We would also like to thank our colleagues at Deloitte Con-

sulting who have supported our efforts. Laura McGoff, Liz Lee, and Anusha

Singuluri were tremendous in helping us obtain reprint permissions, creating

the exhibits, and ensuring that we fulfi lled all requirements of our fi rm. Lisa

Iliff provided a careful and thoughtful review of the fi nal manuscript and Josh

Skwarczyk tracked down references and citations to support our narrative. In

addition, we had the good fortune of working with our editors at Routledge,

where Sharon Golan, acquisitions editor, and Erin Arata, editorial assistant,

were very thoughtful and exhibited great patience in guiding us to the end

product.

Finally, Tom Nagle would like to thank his wife, Leslie, for her patience

and diligent copy editing which she has generously provided through 32 years

of marriage and six editions of this book. Georg Müller thanks his wife Kathy

and son Oskar for their unwavering support and encouragement while he

spent his evenings and weekends writing and developing this book.

NOTE

This publication contains general information only and is based on the experi-

ences and research of Deloitte practitioners. Deloitte is not, by means of this

publication, rendering accounting, business, fi nancial, investment, legal, tax,

or other professional advice or services. This publication is not a substitute

for such professional advice or services, nor should it be used as a basis for

any decision or action that may affect your business. Before making any deci-

sion or taking any action that may affect your business, you should consult a

qualifi ed professional advisor. Deloitte shall not be responsible for any loss

sustained by any person who relies on this publication.

IN-LINE BOXES

Chapter 1: Strategic Pricing

The Story of the Mustang 1 3

Chapter 2: Economic Value

The Problem with Customer Value Modeling 4 6

Chapter 4: Price Structure

Evolution of the Price Metric for Mobile Video Games 9 0

Value-Based Pricing Finances Hamlet’s Castle 9 3

Chapter 6: Price Level

Factors That Infl uence Price Sensitivity 147

Chapter 7: Price Competition

Market-Share Myth 154

Chapter 8: Measurement of Price Sensitivity

Using Panel Data to Measure the Impact of Promotion on Choice 177

Measuring Price Sensitivity for e-Books 184

Purchase Probability Curves: A Simple Buy-Response Study—

Opportunity for a Higher Price 187

A Conjoint Study: Blue Sky Ski Company 194

Chapter 11: Creating a Strategic Pricing Capability

Assessing the Maturity of the Pricing Organization 266

Exploring New Ways to Manage a Price Increase: Lessons from Netfl ix 270

Creating a Sales Incentive to Drive Profi t 278

EXHIBITS

1-1 Breakeven Sales Curve Associated with Different

Price Changes 9

1-2 The Value Cascade: Strategic Pricing Requires Effective

Management of Both Value and Price 11

1-3 Value-Based Pricing Involves Offering Customers “Good Value” 13

2-1 Economic Value Estimation (EVE

®

) Model 29

2-2 Non-Normalized Reference Price Data 32

2-3 Normalized Reference Data 33

2-4 Examples of Value Driver Algorithms for

Equipment Manufacturer 35

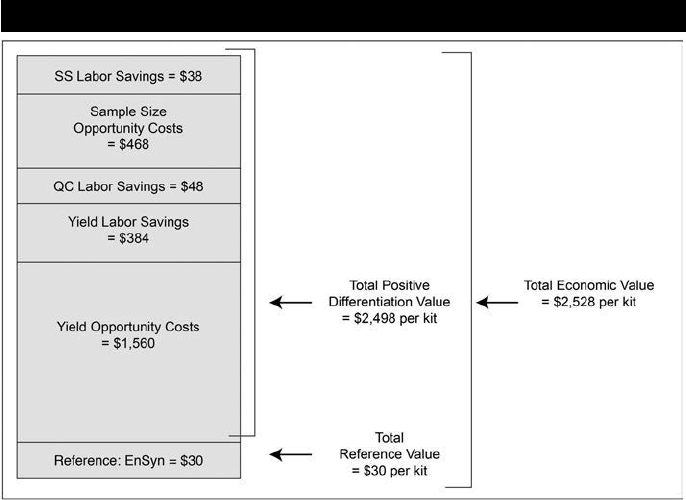

2-5 Monetary Value Estimation for Dyna-Test Industrial Buyers 38

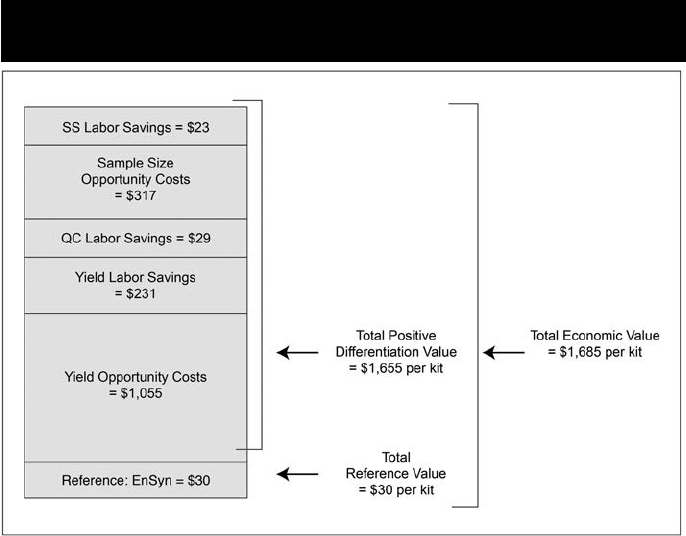

2-6 Monetary Value Estimation for Dyna-Test Academic

and Government Buyers 39

2-7 Monetary Value Profi le for Dyna-Test 40

2-8 Impact of Warranty Length on Willingness-to-Pay 43

2-9 Difference in Willingness-to-Pay and Market

Potential by Segment 44

2-10 Primary and Secondary Segmentation: Catalog

Printing Industry 52

2-11 Characteristics of Three Printer Customer Segments 53

3-1 Purchase Involvement and Benefi t Types for Products

and Services 59

3-2 Economic Value Messages for Low-Involvement Goods 61

3-3 Spreadsheet Value Communication Tool 63

3-4 Distribution of Value Across the Organization 73

4-1 The Incremental Contribution from Segmented Price Structure 77

4-2 Segmented Price Structure in Airlines 81

4-3 Revenue Optimizing Subscription Pricing by Segment 82

4-4 Criteria for Evaluating Pricing Metrics 86

4-5 Hosted Call Center Software 88

4-6 Step-Price Schedule for Electricity 101

5-1 Typical Capabilities of Purchasing Versus Sales 109

5-2 Cycle of Reactive Price Negotiation 115

5-3 Cycle of Proactive Policy-Based Price Negotiation 117

5-4 Buyer Types 119

6-1 The Six-Step Process for Setting Prices 135

6-2 Illustration of the Reasonable Price Range 136

6-3 Constant Profi t Curve Associated with Different Price Changes 144

6-4 Breakeven Sales Changes Required Given Different

Contribution Margins 145

7-1 Thoughtfully Reacting to Price Competition 160

8-1 Techniques for Measuring Price Sensitivity 174

8-2 Regression Analysis Results 178

8-3 Use of Regression Analysis 181

8-4 e-Books: Purchase Rate by Price 185

8-5 Purchase Probability Curve for Financial Software 187

Exhibitsxx

8-6 Total Revenue Estimate for Financial Software 188

8-7 Analysis of Youth-Seeking “Innovators” Segment 195

8-8 Effect of Warranty on Take Rate 196

9-1 Analysis of Music Festival Revenue Options 211

9-2 Finding the Breakeven Sales Change 216

9-3 Breakeven Sales Analysis and Simulated Scenarios: Westside

Manufacturing’s Proposed 5 Percent Price Reduction 221

9-4 Breakeven Analysis of a Price Change 222

9-5 Breakeven Sales Curve Calculations (with Incremental

Fixed Costs) 224

9-6 Breakeven Sales Curve: Trade-Off Between Price and Sales

Volume Required for Constant Profi tability 225

9-7 Breakeven Sales Curve: Relationship Between Price Elasticity

of Demand and Profi tability 226

9-8 Breakeven Sales Curve: Relationship Between Price Elasticity

of Demand and Profi tability: Changes in Profi t with More

Inelastic Demand 227

9A-1 Cost Projection for Proposed Crop of Mums 231

9A-2 Relevant Cost of Mums 232

9A-3 Breakeven Sales Changes for Proposed Price Changes 233

9A-4 Breakeven Sales Change Simulated Scenarios

(Vertical Orientation) 234

9A-5 Profi t Impact of a 10 Percent Increase 236

9B-1 Breakeven Sales Change Relationships 238

10-1 Sales and Profi ts Over the Product’s Life, from

Inception to Demise 241

10-2 Alternative Strategic Choices for Foreign Market Sales 249

10-3 Stratagies for Managing Foreign Exchange Rate Adjustments 251

10-4 Ineffi ciencies in Transfer Pricing 256

10-5 Effi ciency from Cost Integration 257

11-1 Archetypal Pricing Organizations 263

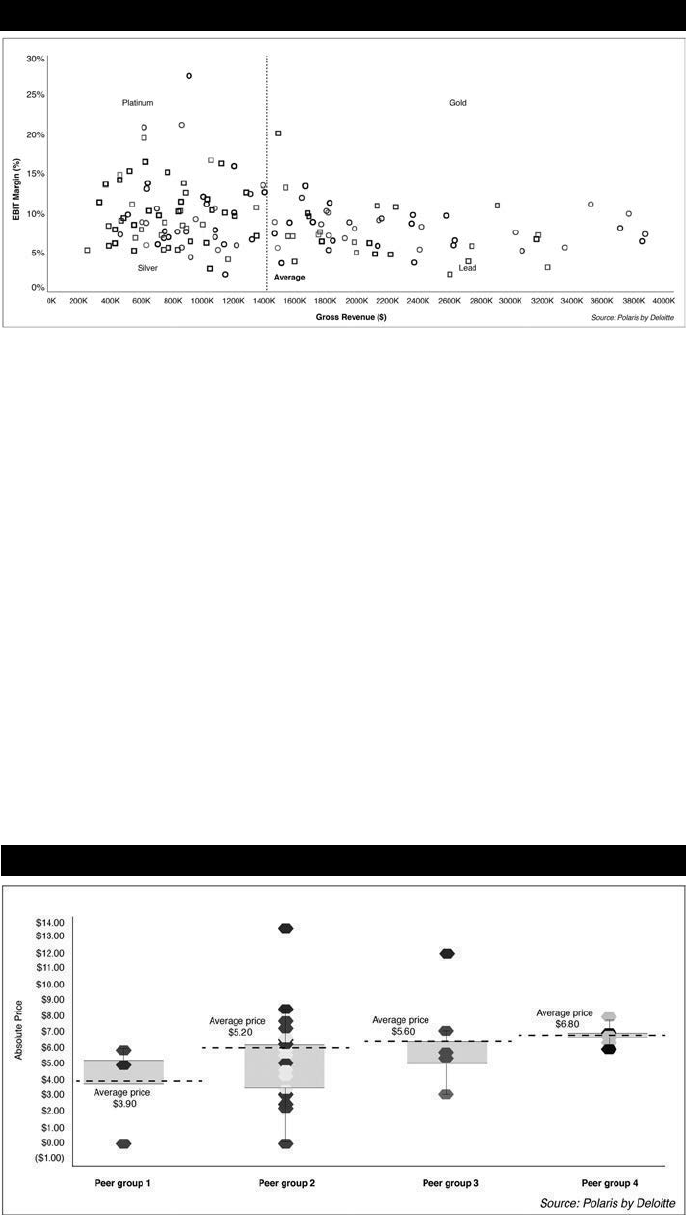

11-2 Operating Profi t Relative to Industry Peers 264

11-3 The Foundation for a Strategic Pricing Capability 266

11-4 Assessing Each Element of the Value Cascade 267

11-5 Pricing Structure Archetypes 272

11-6 Types of Decision Rights 273

11-7 Map of Decision-Making Process for a

Manufacturing Company 275

11-8 Illustrative Data Sources for Pricing Analytics 280

11-9 Customer Profi tability Map 282

11-10 Customer Profi tability by Peer Group 282

11-11 Price Band Analysis 283

11-12 Price Waterfall Analysis 285

12-1 When Is Price Ethical? Ethical Constraints 294

CHAPTER 1

Strategic Pricing

Coordinating the Drivers of Profi tability

If you have to have a prayer session before raising the price by 10 percent, then

you’ve got a terrible business.

Warren Buffet

1

Marketing consists of four key elements: The product, its promotion, its

placement or distribution, and its price. The fi rst three elements—product,

promotion, and placement—comprise a fi rm’s effort to create value in the

marketplace. The last element—pricing—differs essentially from the other

three: It represents the fi rm’s attempt to capture some of the value in the profi t

it earns. If effective product development, promotion, and placement sow the

seeds of business success, effective pricing is the harvest. Although effective

pricing can never compensate for poor execution of the fi rst three elements,

ineffective pricing can surely prevent those efforts from resulting in fi nancial

success. Regrettably, this is a common occurrence.

Complicating matters, the ability to harvest potential profi ts is in a con-

tinuous state of fl ux as technology, regulation, market information, consumer

preferences, or relative costs change. Consequently, companies that expect to

grow profi tably in changing markets often need to break old rules, includ-

ing those that govern how they will set prices to earn revenues. Our interest

in strategic pricing dates back to when the telecommunications industry was

deregulated in most developed countries and new suppliers recognized that

they could gain both market share and profi tability by replacing the then pre-

vailing price-per-minute revenue models with more innovative models—fi rst

including a price per month for a bundle of “peak” minutes plus “free” off-

peak time. Later, they introduced “family plans” involving the sharing of min-

utes across numbers. Similarly, Apple quickly went from nothing to market

leadership in music sales, in large part because, after the internet slashed the

cost of distribution, it was the fi rst to recognize that it was better to price music

by the song than by the album. And at the time of writing this edition, the

predominant revenue model for music is shifting yet again, with subscription-

based streaming services such as Spotify and Apple Music

®

overtaking digital

Chapter 1 • Strategic Pricing2

music store sales.

2

Producers of new online media created a new metric for

pricing ads—cost per click—that aligned the cost of an ad more closely to its

value than was possible in traditional print media. Even governments have

begun to use prices, often called “user fees,” instead of taxes to raise revenues

and better allocate scarce resources. Congested cities, such as London and

Singapore, charge to drive a car into congested areas during peak times and

highways in major U.S. cities such as Atlanta and Minneapolis increasingly

have express lanes that are kept moving even during rush hours by adjusting

a wirelessly collected price to access them.

3

Unfortunately, few managers, even those in marketing, have been trained

in how to develop innovative pricing strategies such as these. Most companies

still make pricing decisions in reaction to change rather than in anticipation of

it. This is unfortunate, given that the need for rapid and thoughtful adaptations

to changing markets has never been greater. The information revolution has

made prices everywhere more transparent and customers more price aware.

4

The globalization of markets, even for services, has increased the number of

competitors and often lowered their cost of sales. The high rate of technologi-

cal change in many industries has created new sources of value for customers,

but not necessarily led to increases in profi t for the producers.

Improvements in technology have driven an explosion of data that

some suppliers are using to target customers they can serve more profi tably:

Either because those customers are more willing to pay for the differentiation

the company can offer or because the company can meet their needs more

cost-effectively than competitors. This is especially true of consumer goods,

where manufacturers used to operate with only minimal and long-delayed

data on where and how well their products were selling in retail stores, and

pricing involved negotiating “trade promotions” with channel intermediar-

ies that may or may not have passed the savings on to end consumers. Now,

with the ability to buy almost “real time” data on how individual package

sizes are selling in types of outlets and in specifi c geographies, manufactur-

ers are able to develop more sophisticated pricing strategies to target specifi c

types of customers and competitors. At the extreme, many retailers charge

online shoppers different prices or offer them different product assortments

based on the type of device they are using to access the site, with the theory

that the type of device can signal a systematic difference in willingness-

to-pay.

5

LEVERAGING PROFIT INTO SUSTAINABLE GROWTH

Learning to make sales more profi tably is the key to achieving sustainable

growth in revenue, market share, and company value over the long haul.

When the fi rst edition of this book was published more than three decades

ago, the idea that profi t margins should be prioritized over growth was seen as

short-sighted. A 1975 study conducted at the Harvard Business School using

the PIMS (which originally stood for Profi t Impact of Market Share) database

of historical market performance of leading global companies reported a

strong, consistently positive, correlation between a company’s market share

and its relative profi tability within an industry.

6

In the Harvard Business Review

article discussing this study, the authors proposed multiple plausible reasons

why a larger market share could enable a company to operate more profi tably.

Chapter 1 • Strategic Pricing 3

That led to an explosion of literature by marketing theorists and leading con-

sultancies advocating aggressively low pricing as an “investment” in growth

that would eventually create “cash cows”—exceptionally profi table revenue

streams requiring little investment to maintain them.

Unfortunately, companies that adopted this approach to pricing, more

often than not, found the theory and the eventual profi tability it promised

lacking. As the PIMS database grew to cover multiple years, more nuanced

relationships were revealed. Although a cross-sectional correlation between

market share and profi tability proved durable, how a company invested to

grow was shown to be a better predictor of fi nancial success. Consequently,

the PIMS organization cleverly redefi ned their acronym to stand for Profi t

Impact of Marketing Strategy.

More recent research by Deloitte Consulting LLP has brought further

clarity to the relationship between growth and profi tability. Deloitte compiled

a time-series dataset of 394 companies, covering the period from 1970 to 2013

with exceptional, mediocre and poor performers matched by industry. The

researchers defi ned “exceptional performance” as a company achieving supe-

rior profi tability (return on assets), stock value, and revenue growth for more

than a decade and sought to understand how a small minority of fi rms man-

age to achieve it. Their conclusion:

a [near term] focus on profi tability, rather than revenue growth or [stock]

value creation, offers a surer path to enduring exceptional performance.

7

So how do marketing and fi nancial managers at exceptional companies achieve

sustainable exceptional profi tability? It is not the result of slashing overheads

more ruthlessly than their competitors. In fact, Deloitte’s data indicates that

exceptional performers tend to spend a bit more than competitors (as a percent

of sales) on R&D and SG&A. Their exceptional profi tability and, eventually,

exceptional stock valuations are built on higher margins per sale that fund

initiatives to grow revenues without compromising those margins.

8

Unfortunately, many companies fail to understand that making sales

profi tably should be the fi rst priority—not an afterthought—of a strategy for

driving growth. Creating and communicating superior value propositions or

fi nding a way to deliver superior value at lower cost is a precondition to sus-

tainable revenue growth. Many years of experience have taught us that apply-

ing the principles explained in these pages is necessary to make sales more

profi table and at least equal with the best in the industry.

The difference between successful and unsuccessful pricers lies in how

they approach the process. To achieve superior, sustainable profi tability, pric-

ing must become an integral part of strategy. Strategic pricers do not ask,

“What prices do we need to cover our costs and earn a profi t?” Rather, they

ask, “What costs can we afford to incur, given the prices achievable in the

market, and still earn a profi t?” Strategic pricers do not ask, “What price is

this customer willing to pay?” but “What is our product worth to this cus-

tomer and how can we better communicate that value, thus justifying the

price?” When value doesn’t justify price to some customers, strategic pricers

do not surreptitiously discount. Instead, they consider how they can segment

the market with different products or distribution channels to serve these

customers without undermining the perceived value to other customers. And

strategic pricers never ask, “What prices do we need to meet our sales or

Chapter 1 • Strategic Pricing4

market share objectives?” Instead they ask, “What level of sales or market

share can we most profi tably achieve?”

Strategic pricing often requires more than just a change in attitude; it

requires a change in when, how, and who makes pricing decisions. For exam-

ple, strategic pricing requires anticipating price levels before beginning prod-

uct development. It requires determining the economic value of a product or

service, which depends on the alternatives customers have available to sat-

isfy the same need. We go into much more depth on the concept of Economic

Value Estimation (EVE

®

) in Chapter 2. The only way to ensure profi table pric-

ing is to reject early those ideas for which adequate value cannot be captured

to justify the cost.

Strategic pricing also requires that management take responsibility for

establishing a coherent set of pricing policies and procedures, consistent with

the company’s strategic goals. Abdicating responsibility for pricing to the sales

force or to the distribution channel is abdicating responsibility for the strategic

direction of the business.

Perhaps most important, strategic pricing requires a new relationship

between marketing and fi nance because pricing involves fi nding a balance

between the customer’s desire to obtain good value and the fi rm’s need to

cover costs and earn profi ts. Unfortunately, pricing at most companies is char-

acterized more by confl ict than by balance between these objectives. If pricing

is to refl ect the value to the customer, specifi c prices must be set by those best

able to anticipate that value—presumably marketing and sales managers. The

problem is that their efforts will not generate substantial profi ts unless con-

strained by appropriate fi nancial objectives. Rather than attempting to “cover

costs,” fi nance must learn how costs change with shifts in sales volume and

use that knowledge to develop appropriate incentives for marketing and sales

to achieve their objectives.

With their respective roles appropriately defi ned, marketing and fi nance

can work together toward a common goal—to achieve profi tability through

strategic pricing.

Before marketing and sales can attain this goal, however, managers in

all functional areas must discard the fl awed thinking about pricing that fre-

quently leads them into confl ict and that drives them to make unprofi table

decisions. Let’s look at these fl awed paradigms so that you can recognize them

and understand why you need to let them go.

COST-PLUS PRICING

Cost-plus pricing is, historically, the most common pricing procedure because

it carries an aura of fi nancial prudence. Financial prudence, according to this

view, is achieved by pricing every product or service to yield a fair return over

all costs, fully and fairly allocated. In theory, it is a simple guide to profi tabil-

ity; in practice, it is a blueprint for mediocre fi nancial performance.

The problem with cost-driven pricing is fundamental: In most industries,

it is impossible to determine a product’s unit cost before determining its price.

Why? Because unit costs change with volume. This cost change occurs because

a signifi cant portion of costs are “fi xed” and must somehow be “allocated” to

determine the full unit cost. Unfortunately, because these allocations depend

on volume, and volume changes as prices change, unit cost is a moving target.

Chapter 1 • Strategic Pricing 5

To solve the problem of determining unit cost before determining

price, cost-based pricers are forced to assume a level of sales volume and then

to make the absurd assumption that they can set price without affecting that

volume. The failure to account for the effects of price on volume, and of vol-

ume on costs, leads managers directly into pricing decisions that undermine

profi ts. A price increase to cover higher fi xed costs can start a death spiral in

which higher prices reduce sales and raise average unit costs further, indicat-

ing (according to cost-plus theory) that prices should be raised even higher.

On the other hand, if sales are higher than expected, fi xed costs are spread

over more units, allowing average unit costs to decline a lot. According to

cost-plus theory, that would call for lower prices. Cost-plus pricing leads to

overpricing in weak markets and underpricing in strong ones—exactly the

opposite direction of a prudent strategy.

How, then, should managers deal with the problem of pricing to cover

fi xed costs? They shouldn’t. The question itself refl ects an erroneous percep-

tion of the role of pricing, a perception based on the belief that one can fi rst

determine sales levels, then calculate unit cost and profi t objectives, and then

set a price. Once managers realize that sales volume (the beginning assump-

tion) depends on price (the end of the process), the fl awed circularity of cost-

based pricing is obvious. The only way to ensure profi table pricing is to let

anticipated pricing determine the costs incurred rather that the other way

around. Value-based pricing must begin before investments are made using a

process that we will describe later in this chapter.

CUSTOMER-DRIVEN PRICING

Many companies now recognize the fallacy of cost-based pricing and its

adverse effect on profi t. They realize the need for pricing to refl ect market

conditions. As a result, some fi rms have taken pricing authority away from

fi nancial managers and given it to sales or product managers. In theory, this

trend is consistent with value-based pricing, since marketing and sales are that

part of the organization best positioned to understand value to the customer.

In practice, however, their misuse of pricing to achieve short-term sales objec-

tives often undermines perceived value and depresses future profi tability.

The purpose of strategic pricing is not simply to create satisfi ed custom-

ers. Customer satisfaction can usually be bought by a combination of overdeliv-

ering on value and underpricing products. But marketers delude themselves if

they believe that the resulting increases in sales represent marketing successes.

The purpose of strategic pricing is to price more profi tably by capturing more

value, not necessarily by making more sales. When marketers confuse the fi rst

objective with the second, they fall into the trap of pricing at whatever buyers

are willing to pay, rather than at what the product is really worth. Although

that decision may enable marketing and sales managers to meet their sales

objectives, it invariably undermines long-term profi tability.

Two problems arise when prices refl ect the amount buyers seem will-

ing to pay. First, sophisticated buyers are rarely honest about how much they

are actually willing to pay for a product. Professional purchasing agents are

adept at concealing the true value of a product to their organizations. Once

buyers learn that sellers’ prices are reactively fl exible, they have a fi nancial

incentive to conceal information from, and even mislead, sellers. Obviously,

Chapter 1 • Strategic Pricing6

this undermines the salesperson’s ability to establish close relationships with

customers and to understand their needs.

Second, there is an even more fundamental problem with pricing to

refl ect customers’ willingness-to-pay. The job of sales and marketing is not

simply to process orders at whatever price customers are currently willing

to pay, but rather to raise customers’ willingness-to-pay to a level that better

refl ects the product’s true value. Many companies underprice truly innova-

tive products because they ask potential customers, who lack prior experi-

ence from which to judge the product’s value, what they would be willing to

pay for it. But we know from studies of innovations that the price has little

impact on whether customers are willing to try them.

9

For example, most

customers initially perceived that photocopiers, mainframe computers, home

air conditioners, and MP3 players lacked adequate value to justify purchase

at viable prices. Only after trial by a small subset of “innovator” customers,

followed by extensive marketing to communicate and guarantee value to a

broader market, did these products achieve market acceptance. Forget what

customers who have never used your product are initially willing to pay.

Instead, understand what the value of the product could be for satisfi ed cus-

tomers, communicate that value to the currently uninformed, and set prices

accordingly. Low pricing is always a poor substitute for an inadequate mar-

keting and sales effort.

SHARE-DRIVEN PRICING

Finally, consider the policy of letting pricing be dictated by competitive con-

ditions. In this view, pricing is a tool to achieve gains in market share. In the

minds of some managers, this method is “pricing strategically.” Actually, it

is more analogous to “letting the tail wag the dog.” Occasionally, network-

ing effects make a product or service more valuable when other people are

patronizing the same brand, as was the case for example with eBay, the online

marketplace. In most cases, however, there is no reason why an organization

should seek to achieve market share as an end in itself.

Although cutting price is probably the quickest, most effective way to

achieve sales objectives, it is usually a poor decision fi nancially. Because a

price cut can be so easily matched, it offers only a short-term market advan-

tage at the expense of permanently lower margins. Consequently, unless

a company has good reason to believe that its competitors cannot match a

price cut, the long-term cost of using price as a competitive weapon usually

exceeds any short-term benefi t. Although product differentiation, advertis-

ing, and improved distribution do not increase sales as quickly as price cuts,

their benefi t is more sustainable and thus is usually more cost-effective in

the long run.

The goal of pricing should be to fi nd the combination of margin and

market share that maximizes profi tability over the long term. Sometimes,

the most profi table price is one that substantially restricts market share rela-

tive to the competition. Godiva chocolates, Apple iPhones

®

, Peterbilt trucks,

and Snap-on tools would no doubt all gain substantial market share if priced

closer to the competition. It is doubtful, however, that the added share

would be worth forgoing their profi table and successful positioning as high-

priced brands.

Chapter 1 • Strategic Pricing 7

Strategic pricing requires making informed trade-offs between price

and volume in order to maximize profi ts. These trade-offs come in two forms.

The fi rst trade-off involves the willingness to lower price to exploit a market

opportunity to drive volume. Cost-plus pricers are often reluctant to exploit

these opportunities because they reduce the average contribution margin

across the product line, giving the appearance that it is underperforming rela-

tive to other products. But if the opportunity for incremental volume is large

and well targeted, a lower contribution margin can actually drive a higher

total profi t. The second trade-off involves the willingness to give up volume

by raising prices. Competitor- and customer-oriented pricers fi nd it very diffi -

cult to hold the line on price increases in the face of a lost deal or reduced vol-

ume. Yet the economics of a price increase can be compelling. For example, a

product with a 30 percent contribution margin could lose up to 25 percent of

its volume following a 10 percent price increase before that move results in

lower profi tability.

Effective managers of pricing regularly evaluate the balance between

profi tability and market share and are willing to make hard decisions when

the balance tips too far in one direction. (We will show you how to make such

calculations later in this book). Key to making those managers effective, how-

ever, is performance measures and incentives that reward them for improving

profi tability, not just revenue.

THE ROLE OF “OPTIMIZING” IN STRATEGIC PRICING

Economic theorists propose pricing based upon estimating the demand

curve for a product and then “optimizing” the price level, given the incre-

mental cost of production. In theory, this is totally consistent with the approach

we propose in this book, but in practice it is almost always impractical. The

reason lies in the assumption that a demand curve is something stable that

one can measure with suffi cient speed and accuracy to continually optimize

it. Contrary to the assumptions that economists make when studying mar-

kets, the demand for individual products or brands within markets is rarely

stable or easily measured. The reason: Sensitivity to price depends as much on

ever-changing purchase contexts and perceptions as on underlying needs or

preferences. For example, contradicting the assumption of a demand curve,

the amount of a product that customers will buy at a particular price point is

strongly affected by the prices they paid recently. When gasoline prices are

rising, the demand for premium grades of gasoline will fall quickly by a much

greater percentage than demand for regular grades. But when prices decline

back to where they started, demand for premium grades will not recover

quickly. That is, demand when prices are going up is generally much more

“price elastic” than when prices are coming down.

More importantly, behavioral economics research over the past few

decades has proven conclusively that differences in how prices are presented

and the surrounding context can lead buyers to respond in ways that are

inconsistent with the idea of a stable demand curve that refl ects fi xed prefer-

ences.

10

For example, if one adds a higher priced product to the choices avail-

able in a store—say a “best” version to go along with a “good” and a “better”

version—economic theory would predict that the higher-priced “best” version

would primarily draw sales from the mid-priced “better” version, which turns

Chapter 1 • Strategic Pricing8

out to be true. What it does not predict is that the mid-priced version will at

the same time gain sales at the expense of the cheapest version even though

the prices of those two versions remain unchanged.

11

To add to the instabil-

ity, we know that the demand for the mid-price product will be greater if

the offers are presented beginning from the top down rather than from the

bottom up.

12

These examples illustrate just a few of the effects that appear to shift

demand curves in ways that are contextual. Still, one cannot deny the fact

that the profi tability of a price increase will depend upon whether the loss

in sales is not too great, while the profi tability of a price decrease depends

upon whether the gain in sales is great enough. Economists refer to the actual

percentage change in sales divided by the percentage change in price as the

price elasticity of demand. Actual elasticity depends in part upon how effectively

marketers manage customer perceptions and the purchase context, as you will

come to see in the following chapters. Moreover, many factors that infl uence

price elasticity are not under the marketer’s control, making precise estimates

of actual price elasticity very diffi cult and only rarely cost effective. Conse-

quently, we have found that instead of asking “What is price elasticity for this

product?” it is often more practical and useful to ask “What is the minimum

elasticity that would be necessary to justify a particular price change?” that

has been proposed to achieve some business objective. To put the question in

less technical jargon, we ask “What percent change in sales would be neces-

sary (which is the same as asking what price elasticity would be necessary) for

a proposed price change to maintain the same total profi t contribution after a

price change?” We refer to the answer as the breakeven sales change associated

with a proposed price change.

If we create a graph of breakeven sales changes associated with different

potential price changes, we can create a breakeven sales curve that looks much

like a demand curve, as shown in Exhibit 1-1, which shows the example of a

product that earns a 45 percent gross margin at a baseline price of $10. It is a

representation of how much demand is needed to maintain current profi tability

as prices change. If actual demand proves to be less elastic (steeper) than the

breakeven sales curve, then higher prices will be more profi table. If the actual

demand proves to be less steep (more elastic) than the breakeven sales curve,

then lower prices will be more profi table. Technical details about how to cal-

culate a correct breakeven sales change for any particular product and pricing

decision are described in Chapter 9.

None of this implies that research to understand demand price elasticity

is not valuable. We are simply observing that, given the usual instability of

demand estimates over the time period required to make them, attempting to

improve profi tability by exactly “optimizing” price levels is usually not prac-

tical. What is valuable is research to understand how differences in identifi -

able purchase contexts (e.g., online versus in-store purchases, standard versus

rush orders) or how marketing strategies to infl uence perceptions of value can

infl uence demand elasticity. Research is also useful when developing offers

to understand the relative impact of different features and services that one

might offer on perceived value.

Finally, we should acknowledge that it is possible in a small number of

markets to measure demand price elasticity accurately in real time, enabling

mangers to track the effect of changes ranging from the weather to the daily

Chapter 1 • Strategic Pricing 9

news, to the time of day can have on them. Consumer packaged goods compa-

nies can purchase huge quantities of scanner-recorded sales data from retail

stores, far more than would ever be practical to generate from market research.

They can then build “big data” statistical models that use such data to measure

price elasticity as precisely as possible by measuring and controlling for many

contextual factors (such as alternatives available in the store and their prices,

the time of day and day of week, the size of the customers total purchase, the

store location) that can infl uence it. In these cases, the effort to make small

price adjustments to optimize profi tability have proven worthwhile.

WHAT IS STRATEGIC PRICING?

As you probably remember from basic economics, the optimal price one can

charge is limited by the demand curve: A summary of what customers are

willing to pay to buy various quantities of volume. Pricing, given the assump-

tions of economics, is simply about optimizing the price level given that

demand. In reality, however, demand for most products and services is not

given. It is created, sometimes thoughtfully and sometimes haphazardly, by

decisions that sellers make about what to offer their customers, how to com-

municate their offers, how to price differently across customers or applications

and how to manage customer price expectations and incentives. Making these

decisions thoughtfully and implementing them effectively to maximize profi t-

ability is what we call “strategic pricing.”

The word “strategic” is used in various contexts to imply different things.

Here, we use it to mean the coordination of otherwise independent activities to

EXHIBIT 1-1

EXHIBIT 1-1

Breakeven Sales Curve Associated with Different Price Changes

Breakeven Sales Curve Associated with Different Price Changes

Chapter 1 • Strategic Pricing10

achieve a common objective. For strategic pricing, the objective is sustainable

profi tability. Achieving exceptional profi tability requires making thoughtful

decisions about much more than just price levels. It requires ensuring that

products and services include just those features that customers are willing to

pay for, without those that unnecessarily drive up cost by more than they add

to value. It requires translating the differentiated benefi ts your company offers

into customer perceptions of a fair price premium for those benefi ts. It requires

creativity in how you collect revenues so that customers who get more value

from your differentiation pay more for it. It requires varying price to use fi xed

costs optimally and to discourage customer behaviors that drive excessive ser-

vice costs. It sometimes requires building capabilities to mitigate the behavior

of aggressive competitors.

Although different strategies can achieve profi table results even within

the same industry, nearly all successful pricing strategies embody three prin-

ciples. They are value-based, proactive, and profi t-driven:

• Value-based means that differences in pricing across customers or appli-

cations refl ect differences in the value to customers. For example, many

managers ask whether they should lower prices in response to reduced

market demand during a recession. The answer: If customers receive less

value from your product or service because of the recession, then prices

should refl ect that. But the fact that fewer customers are in the market

for your product does not necessarily imply that those who remain value

it less than when they were more numerous. Unless a close competitor

has cut its price giving customers a better alternative, there may be no

value-based reason for you to do so.

• Proactive means that companies anticipate disruptive events (for exam-

ple, a new competitive threat or a customer’s decision to award business

via a reverse auction) and develop strategies in advance to deal with

them. For example, anticipating that a recession or a new competitive

entry will cause customers to ask for lower prices, a proactive company

develops a lower-priced service option or a loyalty program, enabling it

to defi ne the terms and trade-offs of the expected interaction, rather than

forcing it to react to terms and trade-offs defi ned by the customer or the

competitor.

• Profi t-driven means that the company evaluates its success at price man-

agement by what it earns relative to alternative investments rather than

by its market share and growth relative to its competitors. When Apple

launched its fi rst iPhone

®

at $499, commentators accused Apple of over-

pricing (with less-featured competitive phones costing no more than

half as much).

13

But Apple easily sold its new innovation to a subset of

“techies” and invested to ensure they had a great experience. Then, when

it cut the price to $399, many more buyers saw it as a bargain. Still, com-

petitors have soon launched knock-offs that copy each of Apple’s new

iPhone innovations within a year or so, and smartphones based upon the

Android platform have overtaken those of Apple in unit sales by a wide

margin.

14

So should Apple be worried? We think not, and neither do

Apple’s investors. With most of its profi ts coming from smartphone sales,

Apple is the most profi table and most valuable company in the world at

the time we are writing this. Moreover, while many of its competitors are

Chapter 1 • Strategic Pricing 11

cutting prices to penetrate large and rapidly growing but lower-income

markets like China, Apple is not. Instead, it is adding more functionality

and building more Apple stores in those markets to ensure that custom-

ers have the same exceptional experience that hooked Apple loyalists

in developed markets, investments it can easily afford given the higher

margins it earns from each buyer.

These three principles will resurface throughout this book as we discuss how

to defi ne and make good choices. Strategic pricing is not a discipline separate

from the rest of marketing strategy; it is rather a set of principles for creating

marketing strategies that drive growth profi tably.

A good pricing strategy involves six distinct but very different choices

that build upon one another. The choices are represented graphically as six

points in what we call the Value Cascade (Exhibit 1-2). The core function of a

successful fi rm is to create value; fi rst and foremost for customers, but also for

the internal constituencies that rely on the fi rm for employment and returns

on investment. Strategic pricing is about managing value, from its creation

through its capture in price setting, in a coordinated way that enables the orga-

nization to achieve a high, sustainable return from its efforts.

The fi rst thing that strikes most people new to the subject of strategic

pricing is that setting a price level is just one step in a multistep process that

impacts the full range of marketing decisions. If the goal of pricing profi tably

EXHIBIT 1-2

EXHIBIT 1-2

The Value Cascade: Strategic Pricing Requires Effective Management

The Value Cascade: Strategic Pricing Requires Effective Management

of Both Value and Price

of Both Value and Price

Chapter 1 • Strategic Pricing12

is considered only when price levels are set, then multiple marketing choices

are likely to be made in ways that will dissipate profi t potential (the “gaps” in

our diagram) well before any product or service is offered for sale.

Although this book contains a chapter devoted to addressing each of

these topics individually, it is useful to have an overall vision—a map if you

will—of how and why they fi t together in this particular order. Both managers

and pricing consultants are often called upon to fi x strategies that are generat-

ing poor fi nancial returns despite driving revenues. Consequently, they may

start anywhere on this choice cascade based upon their initial assessment of

the potential for improvement. For our overview, we will follow the order of

the numbers in the exhibit, which refl ect the order in which you would typi-

cally need to address these issues if building the marketing strategy for a new

product or service from scratch.

VALUE CREATION

It is often asserted as a truism that the value of something is whatever someone

will pay for it. We disagree. People sometimes pay for things that soon disappoint

them in use (for example, time-share condominiums). They fail to get “value for

money,” do not repeat the purchase, and discourage others from making the

same mistake. At the other extreme, people are often reluctant to pay any price

for radical new innovations simply because they lack the experience, either their

own or that of someone else whose judgment they trust, from which to judge

the value that the innovation could bring to their lives. For companies trying to

gain share in established markets by creating differentiated product and service

offerings, the challenge is simply to get customers already in the market to pay a

premium price that exceeds the added cost to deliver that differentiation.

Of course, it is sometimes possible to deceive people into making one-

time purchases at prices ultimately proven to be unjustifi ed, but that is not

a viable strategy for an ongoing enterprise, nor is it our agenda in this book.

Our intention is to show marketers how to create value cost-effectively and

convince people to pay prices commensurate with that value. We expect that,

as a result, those of you who apply these ideas will contribute to an economic

system in which fi rms that are more adept at creating value for customers are

most rewarded with higher margins and market value.

Some companies that have exceptional technologies and capabilities with

the potential to create great value fail to convert them into offers that generate

exceptional, or even adequate, profi tability. They make the mistake of believ-

ing that more, from a technological perspective, is necessarily better for the

customer. One of us worked for a company making high-quality offi ce furni-

ture that was disappointed by its low share in fast-growing, entrepreneurial

markets. The company wanted a strategy to convince those buyers what more

established companies recognized already: That highly durable offi ce furniture

that would hold its appearance and function for 20 or more years was a good

investment. But it took only a few interviews with buyers in the target mar-

ket to recognize the problem. Companies in this market expected either to be

bought out in fi ve years or be gone. The problem was not that customers did

not recognize the differentiating benefi ts of the company’s products. It was that

the target market saw little value associated with those benefi ts.

Exhibit 1-3 illustrates the fl awed progression of cost-plus pricing and the

necessary progression for value-based pricing. Cost-based pricing is product

Chapter 1 • Strategic Pricing 13

The Story of the Mustang

Product development driven by value-based pricing is still the exception,

but not among the most successful product launches. One early example

of a successful new product built to be a “good value” was a spectacularly

successful car developed at Ford Motor Company. Five decades ago, Ford

regained its footing by building the fi rst sports car to sell at a price point

that middle-class people could afford. From an engineering perspective, it

was not the most technically advanced. From the customers’ perspective,

it represented a better value than anything else in the market. From a sales

and profi t perspective, it was one of the most successful car launches in

history and continues to sell today in its sixth generation.

driven. Engineering and manufacturing departments design and make what

they consider a “good” product. In the process, they make investments that

incur costs to add features and related services. Finance then totals these costs

to determine a “target” price. Only at this stage does marketing enter the pro-

cess, charged with the task of demonstrating enough value in the product to

justify pricing to customers.

If the cost-based price proves unjustifi able, managers may try to fi x

the disappointing sales by allowing “fl exibility” in the price. Although this

tactic may help meet the sales goal, it is not fundamentally a solution to the

problem of pricing profi tably. That problem will arise again as the features

and costs of the new products continue to mismatch the needs and values of

customers.

Solving the problem of product development and costing disconnected

from value to the customer requires more than a simple fi x. It requires a com-

plete reversal of the process. For value-based pricing, the target price is based

on an estimate of value, not costs. The target price then drives decisions about

what costs to incur, rather than the other way around.

EXHIBIT 1-3

EXHIBIT 1-3

Value-Based Pricing Involves Offering Customers “Good Value”

Value-Based Pricing Involves Offering Customers “Good Value”

Chapter 1 • Strategic Pricing14

In the early 1960s, America was young, confi dent, and in love with

sports cars. Many popular songs of the era were odes to those cars. Unfor-

tunately for Ford, the cars arousing the greatest passion were made by

other auto manufacturers. Hoping to remedy this situation, Ford set out

to build a sports car that would tempt buyers to its showrooms.

Had Ford followed the traditional approach for developing a new

car, management would have begun the process by sending a memo to

the design department, instructing it to develop a sports car that would

top the competition. Each designer would then have drawn on individ-

ual preconceptions of what makes a good sports car in order to design

bodies, suspensions, and engines that would be better. In a few weeks,

management would have reviewed the designs and picked out the best

prospects. Next, management would have turned those designs over

to the marketing research department. Researchers would have asked

potential customers which they preferred and whether they liked Ford’s

designs better than the competition’s, given prices that would cover their

costs and yield the desired rate of return. The best choice would ulti-

mately have been built and would have evoked the adoration of many,

but it would have been purchased by only the few who could have

afforded it.

Fortunately, Ford had a better idea. Unlike at other companies, the

leading manager in charge of the project was not an expert in fi nance,

accounting, or production. He was a marketer. So Ford did not begin

looking for a new car in the design department. The company began by

researching what customers wanted. Ford found that a large and growing

share of the auto market longed for a sports car, but that most people could

not afford one. Ford also learned that most buyers did not really need much

of what makes a “good” sports car to satisfy their desires. What they craved

was not sports-car performance—requiring a costly engine, drive train,

and suspension—but sports-car excitement—styling, bucket seats, vinyl

trim, and fancy wheel covers. Nobody at the time was selling excitement

at a price that most customers could afford: Less than $2,500.

The challenge for Ford was to design a car that looked suffi ciently

sporty to satisfy most buyers, but without the costly mechanical elements

of a sports car that drove its price out of reach. To meet that challenge,

Ford built its sports car with the mechanical workings of an existing econ-

omy car, the Falcon. Many hard-core sports-car enthusiasts, including

some at Ford, were appalled. The car did not match the technical perfor-

mance of some of its competitors, but it was what many people wanted,

at a price they could afford.

In April 1964, Ford introduced its Mustang sports car at a base price

of $2,368. More Mustangs were sold in the fi rst year than any other car

Ford ever built. In just the fi rst two years, net profi ts from the Mustang

were $1.1 billion in 1964 dollars.* That was far more than any of Ford’s

competitors made selling their “good” sports cars, priced to cover costs

and achieve a target rate of return.

Ford began with the customers, asking what they wanted and what

they were willing to pay for it. Their response determined the price at

which a car would have to sell. Only then did Ford attempt to develop a

Chapter 1 • Strategic Pricing 15

In the last two decades, designing product and service offers that can drive

sales growth at profi table prices has gone in the past two decades from being

unusual to being the goal at most successful companies.

15

From Marriott to

Boeing, from medical technology to automobiles, profi t-leading companies

now think about what market segment they want a new product to serve,

determine the benefi ts those potential customers seek, and establish target

prices those customers can be convinced to pay. Value-based companies chal-

lenge their engineers to develop products and services that can be produced at

a cost low enough to make serving that market segment profi table at the target

prices. The fi rst companies to successfully implement such a strategy in an

industry gain a huge market advantage. The laggards eventually must learn

how to manage value just to survive.

The key to creating good value is fi rst to estimate how much value differ-

ent combinations of benefi ts could represent to customers, which is normally

the responsibility of marketing or market research. In Chapter 2, we defi ne

more clearly what we mean by “value” and describe ways to estimate it.

VALUE COMMUNICATION

Understanding the value your products create for customers can still result in

poor sales unless customers recognize the value they are obtaining. A success-

ful pricing strategy must justify the prices charged in terms of the value of the

benefi ts provided. Developing price and value communications is one of the

most challenging tasks for marketers because of the wide variety of product